What a nice day we had yesterday!

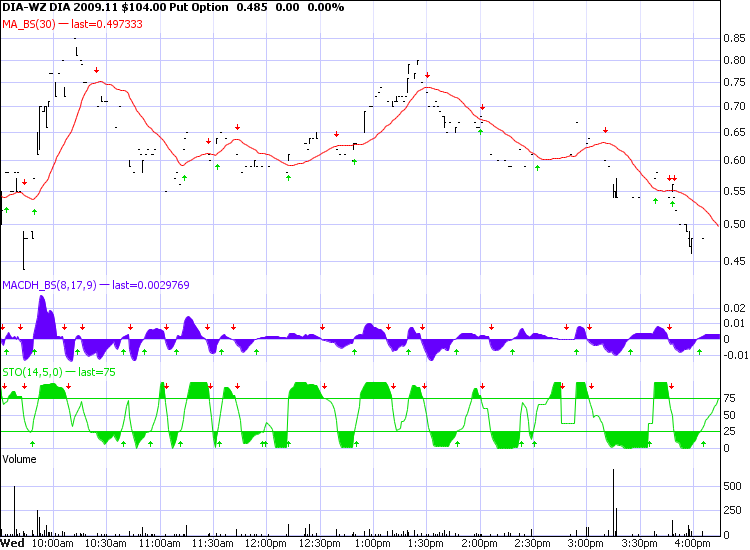

I led off my morning post saying it was time to short the Dow, Copper, Oil and the Euro and anyone playing those futures bets off my 8:27 post made out like a bandit. I even posted a nice little DIA play FOR FREE (for those of you who can’t be bothered to subscribe yet), picking the DIA $104 puts at .55. It only took 45 minutes for those puts to shoot up to .85 and I warned our Members to take it off the table on the way up and, since it was my free trade of the week, I also posted it over at Stock Talk on Seeking Alpha. This is a great way to follow-up on some of our trades and is also the back-up for our member chat whenever we have server issues so do make sure you are signed up to follow me there (just click on my picture).

Yes, I know that so many newsletter writers give you free trade ideas that make 54% in 45 minutes that it’s hard to keep track so only do it if you REALLY want to. The futures, of course, make TONS more than that as they are heavily leveraged, As I said in yesterday’s post, we have been trying to get more bullish but sometimes we just have to put our bearish foot down. In Member Chat we also took bullish pokes at EDZ, SRS, DIA $103 puts and ERY early in the morning and then we were able to just sit back and watch the dip. I was a penny early calling a bottom on copper at $3.12 but .05 on the futures contracts is a huge win and we are very nervous bears, especially on low volume days.

Yes, I know that so many newsletter writers give you free trade ideas that make 54% in 45 minutes that it’s hard to keep track so only do it if you REALLY want to. The futures, of course, make TONS more than that as they are heavily leveraged, As I said in yesterday’s post, we have been trying to get more bullish but sometimes we just have to put our bearish foot down. In Member Chat we also took bullish pokes at EDZ, SRS, DIA $103 puts and ERY early in the morning and then we were able to just sit back and watch the dip. I was a penny early calling a bottom on copper at $3.12 but .05 on the futures contracts is a huge win and we are very nervous bears, especially on low volume days.

At 1:40, I said to members: “DIA – Well mission accomplished on the $103 puts and now we see what Mr. Stick can accomplish for the day. Without the RUT over 600 I have no desire to cover the March puts” and we even decided to go with the DIA $104 CALLS at 3:20 to protect us against the anticipated stick save. Those went from .65 to to .80 into the close, another very quick 20%. We don’t do this all the time, these plays are fun to make during expiration week as the premiums are low and there are huge short-term rewards for good market timing. Our longer-term short play for the Dow was the DIA Dec…