The news last night was so bad it was good!

The news last night was so bad it was good!

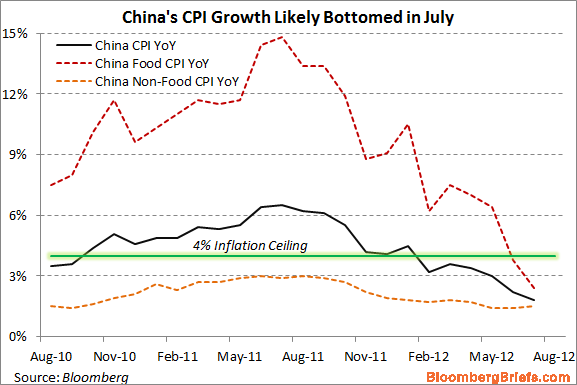

China’s July PPI fell a whopping 2.9% and this total collapse of the Chinese Economy since last summer is now so dramatic that even inflation (ex-food and energy, of course) is down to about 2% and you know what that means – NOW CHINA CAN PUMP MORE MONEY INTO THE ECONOMY!!!

That’s right, the answer to every question in the post-Draghi era of Central Bankster BS is: MORE FREE MONEY! No actual free money of course, but rumors of free money which, we now have learned – is way better at propping up the stock market than actual money because actual money is finite while imaginary, anticipated money is infinite.

And because the rumored money is infinite and apparently comes from sources that won’t add to anyone’s debt (because we don’t imagine consequences, do we?) or be a tax or devalue existing currencies – we can use just about any excuse to say “here it comes!“

It’s like taking the kids outside on Christmas Eve and having them stare into the sky looking for Santa’s sleigh. After about 20 minutes – someone’s going to see something and you (playing the role of the WSJ) will immediately shout – “Yes, I saw it too – that’s definitely him!” Of course, (spoiler alert) he never actually comes – but the kids are asleep by then and you can fake the whole thing while they’re not looking.

It’s like taking the kids outside on Christmas Eve and having them stare into the sky looking for Santa’s sleigh. After about 20 minutes – someone’s going to see something and you (playing the role of the WSJ) will immediately shout – “Yes, I saw it too – that’s definitely him!” Of course, (spoiler alert) he never actually comes – but the kids are asleep by then and you can fake the whole thing while they’re not looking.

Maybe that’s Draghi’s plan – while we’re all sleeping he’s going to come down the chimney and put a Trillion Euros under Spain’s pillow and then say it was a gift from the currency fairy.

Hopefully the currency fairy will visit the US too as the CBO just calculated that our fiscal gap – the only realistic measure of our long-term budget outlook as it includes those “obligations” no one like to talk about, like all the SS and Medicare and Retirement benefits that we’ve already promised to hundreds of millions of Americans. That deficit has grown by $11 TRILLION in the past 12 months!

Some question whether “official” and “unofficial” spending commitments can be added together. But calling particular obligations “official” doesn’t make them economically more important. Indeed, the government would sooner renege on Chinese holding U.S. Treasuries than on Americans collecting Social Security,…

Some question whether “official” and “unofficial” spending commitments can be added together. But calling particular obligations “official” doesn’t make them economically more important. Indeed, the government would sooner renege on Chinese holding U.S. Treasuries than on Americans collecting Social Security,…