Not much in the news today but the futures are way off at 7am.

Not much in the news today but the futures are way off at 7am.

I’m assuming that will, as usual change. They are already boosting the pound back to $1.66 and the Euro is at $1.452 but getting stronger and the Yen ran back down to 92 for a dollarlong enough to give exporters and excuse to lead the Nikkei back over 10,500 (in an amazingly fake-looking finish after a major gap up in their futures) while the Hang Seng managed to close before giving up more than half of their 400-point gap up, making them look nice and green with a net 218-point gain on the day (up 1%).

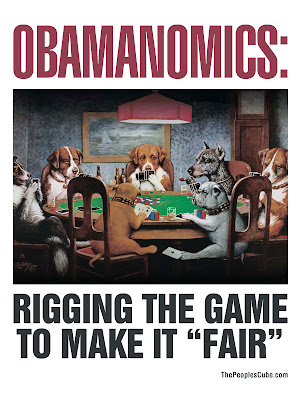

I know you don’t want to hear this. You don’t want to believe that the markets are being manipulated and you don’t want to think you can’t rely on your charts or numbers you read in the papers (or the articles for that matter)as it might prove that you have as little ability to predict the markets as a soap-opera viewer had of predicting who will be the next character to have an affair. Like a soap-opera, the stock marketis written for television, has a regular cast of writers (theMSM) andmakes little sense to people who come in late to the game.

We, at Philstockworld, do not care if the game is rigged. As long as we can figure out HOW it’s rigged, we know where to place our bets and we can make money from it. So don’t take this as me being down on the market – we love this stuff! Yesterday I told you, before the market opened (in fact our Newsletter title at 8:30 was “Beware the Beige Book Blues“) that the FACTS of the Beige Book would override the hype of market. We followed through with our plan to short the Dow into theBBook release and wewere able to pick up the DIA $95 puts for .75 and sell them for $1.10, which is a 46% gain on the day. Even if you play conservative and risk just 1% on a day-trade, that’s still half a point added to your whole portfolio’s gains for the year – that’s pretty good stuff!

We, at Philstockworld, do not care if the game is rigged. As long as we can figure out HOW it’s rigged, we know where to place our bets and we can make money from it. So don’t take this as me being down on the market – we love this stuff! Yesterday I told you, before the market opened (in fact our Newsletter title at 8:30 was “Beware the Beige Book Blues“) that the FACTS of the Beige Book would override the hype of market. We followed through with our plan to short the Dow into theBBook release and wewere able to pick up the DIA $95 puts for .75 and sell them for $1.10, which is a 46% gain on the day. Even if you play conservative and risk just 1% on a day-trade, that’s still half a point added to your whole portfolio’s gains for the year – that’s pretty good stuff!

Another conspiracy we drone on and on about is the good old “stick save.” Perhaps it’s not a conspiracy aimed at propping up the markets on low volume, perhaps it’s a natural phenomenon of the markets that makes it move up…