Wow what a rally!

Wow what a rally!

No, not yesterday but, once people stop trading, then – Wow! The Hang Seng gapped up 200 points at their open and then flew up another 100 points in the last 20 minutes of trading to make 297 points for the day. The Shanghai, of course, followed suit and the Nikkei was stubborn, opening up 75 but then giving it all back but then bouncing and rallying 100 after lunch for a 1.4% gain to 11,244. This was such exciting news to the FTSE that they gapped up as well and they are up 0.75% at lunch while the DAX popped up for a .75% gap open too and are at 0.84% into their lunch. Isn’t this exciting?

Clearly we are in a manic phase for the global markets and the mood swings in our local markets are getting wilder every day. Check out yesterday’s action on the Russell, Nasdaq and Dow futures all the way up to 7am this morning:

Wheee – that’s some wild stuff isn’t it? The Dow is our headliner so the pump monkeys like to make sure it’s as high as possible so they can get the suckers into the tent. As I often remark to Members, the chart action looks a lot like a hospital patient who is flatling and occassionally gets another shot to get the heart going again but, as soon as the stimulus is removed, they go back to fading out.

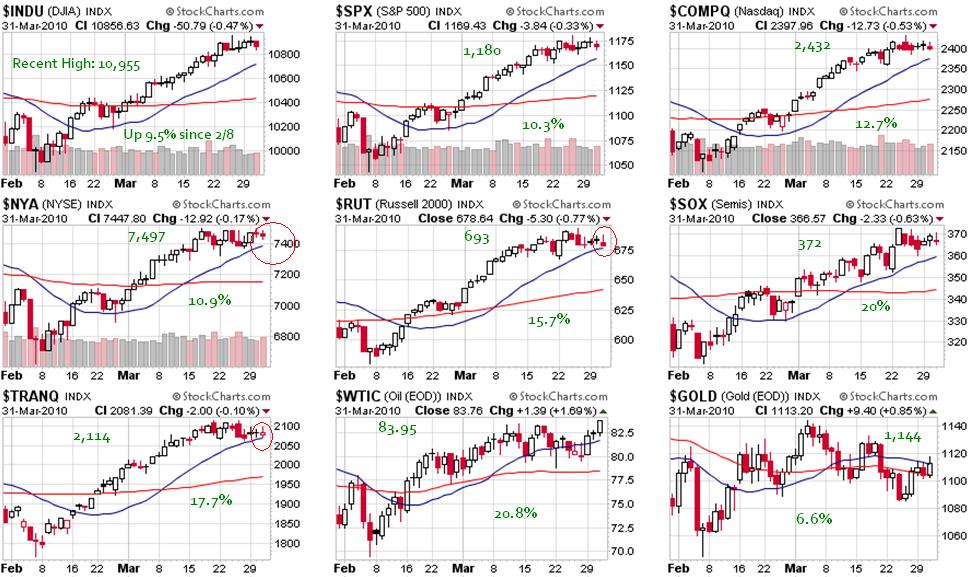

Today we only care about one thing – Can we make new highs? On Monday I said it was going to be “11,000 or Bust” and anything less than that is going to be a huge disappointment going into the weekend. Let’s take a quick look at our major indicators and see what our goals are going to be:

Other than gold – that is a very impressive group! Since we cashed out at the highs, I’m not regretting moving to the sidelines just yet but they sure are trying to pull us back in with this week’s rally. We’re not too convinced with the low volumes and all but, if we do make our breakouts, then we set a new set of breakdown levels at: Dow 11,000, S&P 1,200, Nas 2,500, NYSE 7,500 and Russell 700 – above which we will be able to switch off our brains and run with the bulls.

Meanwhile, we’ll be keeping a close eye on our weakening indicators (see…

Meanwhile, we’ll be keeping a close eye on our weakening indicators (see…