Is today the day we break the pattern?

I predicted a wild week on Monday morning and we have been having a fabulous time as it only took me until 12:51 on Monday afternoon to point out to members that we were following a virtually identical pattern to the previous week. That enabled us to anticipate the gap down on Tuesday morning, as well as yesterday’s stick save. In fact, I predicted the Dow would close at 8,050 and missed it by 7 points. Our short plays that day were MA (which we cashed in yesterday with a huge gain), BIDU and FSLR. The last two are still trading up and I really like BIDU as a proxy for a possible disappointment from GOOG this evening. Also, we got a downward revision to China’s GDP today to “just” 6.1% growth.

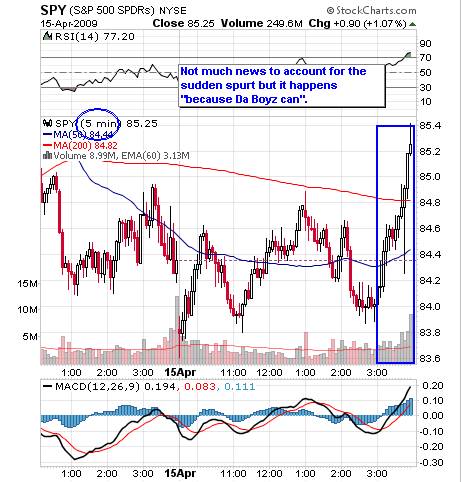

I often say to members “We don’t care if the markets are fixed, as long as we know HOW they are fixed” and yesterday was a great example of that as we digested theBeige Bookreport and, at 2:53, with the S&P spiking down to839,I was able to post a reminder “20 minutes until stick save” and put up a trade idea for the FAS $6 calls at $2.15 (because they had almost no premium), which closed out at $2.90 an hour later (up 34%).

I often say to members “We don’t care if the markets are fixed, as long as we know HOW they are fixed” and yesterday was a great example of that as we digested theBeige Bookreport and, at 2:53, with the S&P spiking down to839,I was able to post a reminder “20 minutes until stick save” and put up a trade idea for the FAS $6 calls at $2.15 (because they had almost no premium), which closed out at $2.90 an hour later (up 34%).

We did not, however, change our overall cover stanceat the closeof 55% bearish. I would have been more bullish if we had NOT moved past 848 on the S&P, there was a sort of frenzied overkill to the “rally” that made me think we would not get the follow-through that we got last Thursday. Also, we had to take into consideration that last Thursday closed the week so we have an extra day (and it’s options expiration day!) to play with so, as I said to members in yesterday’s chat, it pays to error on the side of caution – just in case.

Today we have the usual 650,000 people losing their jobs (yawn) along with anemic Building Permits and Housing Starts (550K each expected) and the Philly Fed at 10 am. The Philly Fed is our biggest worry as it is almost certain to be worse than the -32 expected because it says right in yesterday’s Beige Book: “Third District manufacturers reported further declines in shipments and new orders, on balance, from February to March. Around one-half of the manufacturers surveyed…