I thought the Fed minutes were just fine.

I thought the Fed minutes were just fine.

I said to Members yesterday, right off the bat at 2:06: “Fed minutes – Raised their unemployment outlook and lowered economic outlook – that’s not good. On the other hand it’s good for those who are looking for QE2. Nervous Nellies getting out but maybe some buyers will come in after that (see David Fry’s chart of the action). Not really big rally fuel but certainly nothing to take us down.”

As I moved on with my normal highlighting of the statement and commentary I threw in aggressive bullish plays on TNA and DIA, pointing out to Members: “These minutes are from 3 weeks ago when everyone was doom and glooming. It affects the Fed too and colors their outlook and has little to do with today’s reality. Think of how many of the issues they worried about are no longer true.. They were worried about Greece, etc and lowered their outlook only very slightly and we have already moved past the EU crisis and we didn’t blow up and domestic demand is not dampened so their concerns of 3 weeks ago are out the window and the initial reaction to the headline spin on this report is INCORRECT!!!”

Another “incorrect” reaction came early this morning as we got the news that China’s GDP “only” grew at 10.3%. What the hell is wrong with people? 10.3% is a lot! China WANTS to slow down their economy. In fact, they have taken pretty drastic steps to put the brakes on and it would have been more worrying if they HADN’T managed to slow things down a little. IHS Global insight points out: “This looks more like a smooth-ish exit from the stimulus cycle, rather than a forebear of nasty things to come. Inflationary pressure has really eased off — for now — with a pullback in CPI and PPI coming in conjunction with the sharp halt in property price rises.”

Another “incorrect” reaction came early this morning as we got the news that China’s GDP “only” grew at 10.3%. What the hell is wrong with people? 10.3% is a lot! China WANTS to slow down their economy. In fact, they have taken pretty drastic steps to put the brakes on and it would have been more worrying if they HADN’T managed to slow things down a little. IHS Global insight points out: “This looks more like a smooth-ish exit from the stimulus cycle, rather than a forebear of nasty things to come. Inflationary pressure has really eased off — for now — with a pullback in CPI and PPI coming in conjunction with the sharp halt in property price rises.”

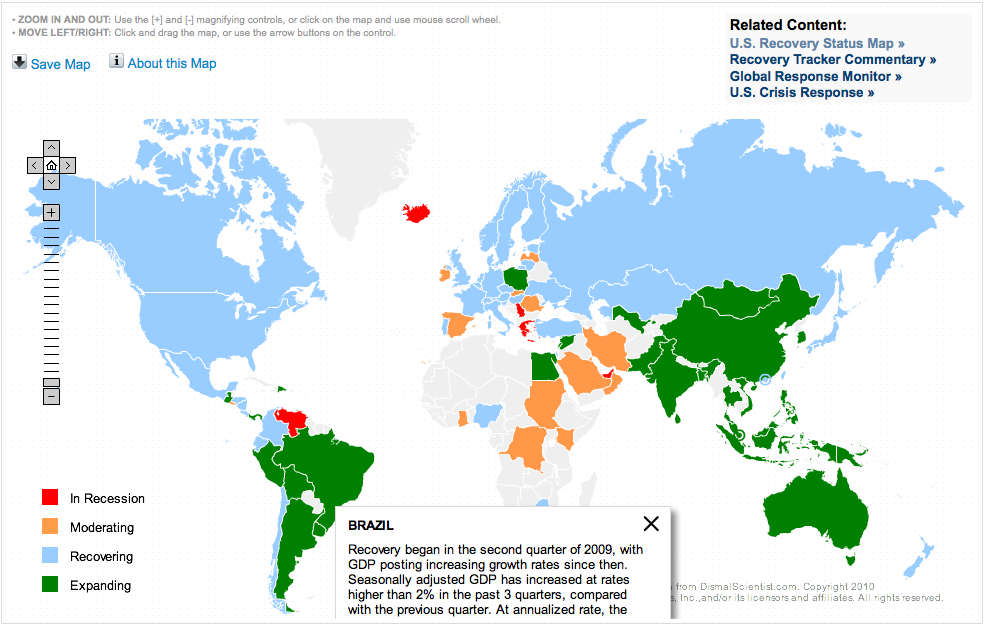

Barry had this nice chart of the Global Recovery Status this morning and, unlike what you may think if you get all your news from the MSM, the global economy is hardly falling off a cliff. In fact, the only countries actually still considered in a recession by Moody’s Analytics are Greece, Iceland, Serbia, UAE and Venezuela. What??? That’s right Mr. Bear – not only are only 5 countries on the planet Earth in recession but there are only 13 other…