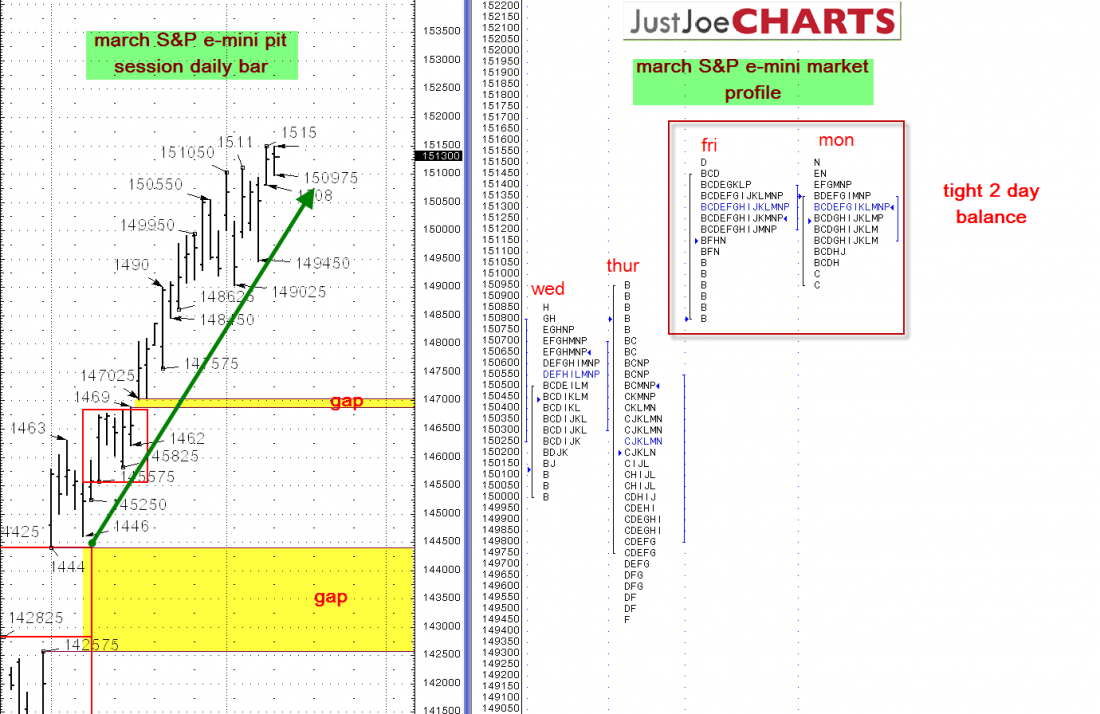

The March S&P E-mini contract has been trading along an upward trendline for the last several months. However, the market is in a relatively tight two-day balance of 1505 to 1515. Additionally, Monday’s range was within Friday’s range marking an inside day on the charts.

BE READY FOR A BREAKOUT

An inside day is a form of balance. When a volatile market such as the S&P breaks from a defined balance, a significant move usually follows. It is possible for the market to remain in the tight balance for another day or so, but it is best to be prepared for the breakout.

UPSIDE MOVE

The S&P contract has been making new multi-year highs for the last several weeks. However, there is an important reference of 1527 on the weekly bar chart from 2008. If the market breaks from the two-day balance to the upside, it may test that 1527 reference.

DOWNSIDE MOVE

The market has been trading along a trendline visible on the daily bar chart for several months. Today’s range could trade down to about 1502 and still remain above the trendline. If the market breaks from the two-day balance to the downside, it may test that 1502 trendline reference.