Many people are familiar with options strategies such as bull call spreads or bear put spreads, but I’d like to discuss the use of a calendar options spread to take advantage of a potential pullback in the S&P 500. The stock market has undergone a significant rally, and although I’d love to believe we are out of the woods and only headed up, I’m not certain of that.

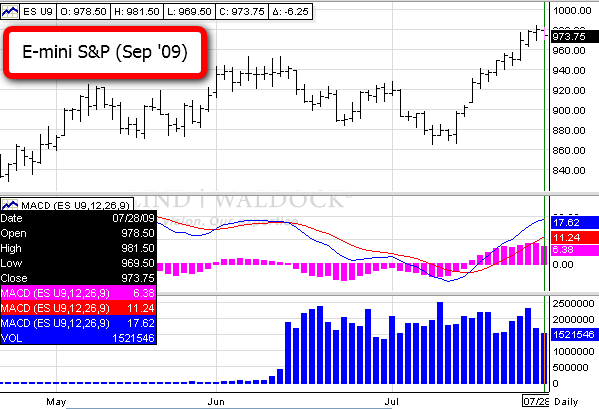

The S&P 500 has rallied 40 percent off its March lows, and is up 11 percent since July 11. I think the market could be due for a correction and it’s a good idea to plan an appropriate strategy.

If you feel the stock market is going to correct but don’t want to face potentially large losses involved with selling a futures contract if you are wrong, you might consider a bear put calendar spread. A calendar options spread is a strategy that involves the purchase and sale of options of the same underlying asset but with different expiration dates (delivery months).

The CME E-mini S&P 500 futures offer excellent execution, liquidity and tight spreads, so that’s the market I will focus on. The calendar spread strategy offers defined risk, and lower initial margins than an outright futures position. The current SPAN margin is about $395 on an E-mini S&P options spread I’ll outline, versus $5,625 for an E-mini S&P contract. (Margins are subject to change at anytime without notice).

The calendar spread involves buying an option on the August S&P E-mini S&P 500 contract, and selling an option on the September contract. By utilizing the calendar spread rather than a vertical bear put spread (buying and selling August options with different strikes), you have the potential for smaller losses if the market moves against you.

On Monday, the E-mini S&P 500 closed at 980, so that’s the level we’ll use to consider choosing options strikes and potential market scenarios. As the market can quickly change, this strategy may or may not be ideal at another given time under different market conditions, and the price of the options and your potential profit-loss scenarios likewise can quickly change.

But for the purposes of example, let’s say you are bearish and bought the 970 August put, trading at about 20 points on Monday, July 27. Each point in the S&P is worth $50, so your cost would be $1,000, not including commissions. You now have the right to sell the August S&P 500 futures at 970 at expiration on August 21. If the market rallies, that position will lose value, and if the market sells off, it has the potential to gain value.

To limit your risk if the market does continue to rally, you sell the September 930 put, which is trading around 18 points. Your cost basis is then about 2 points (20 points paid for the August option minus 18 premium collected for the September option), or $100, not including commissions. As mentioned previously, you would also need margin of just under $400 to hold the position.

Why the September 930 put? Obviously, it’s further below the market, but it represents an area that at one point was strong resistance. Before the market sold off in early July, that area was a strong consolidation area. Old resistance often becomes new support, so a little bad news could bring a pullback and that level looks like a potential target on the downside.

With this strategy, you want to bring in as much premium as you can, but don’t want to shortchange yourself. So even though it’s a calendar, it’s still 40 points wide. If you had instead chosen to sell the August 930 put instead of the September put, your cost basis would be 12 points, or $600, not including your commissions, as the August 930 option was trading at 8 points. You still need the same margin to hold the position. Obviously, the calendar spread is a less expensive way to trade your bearish point of view.

Obviously we are only speculating on different outcomes as we don’t know exactly where the market will be, but we can look at a few possible scenarios and determine our potential profits or losses. If the S&P 500 is at 900 at expiration, your August 970 put would be worth 70 points. The September 930 put would be worth approximately 42 points, as there is intrinsic value in that position, as well as time value remaining until its expiration date. So taking 70 – 42 , we get about 27 points x $50, which gives you $1,362 as your profit potential, not including commissions.

Say you are wrong in your assumption the market will sell off, and the S&P continues to rally to 1,050 by August 21. At 1,050, the August put expires worthless and you lose what you paid for it. The September put is out-of-the money but still has time value remaining. If your August option expires worthless, you would then look then to close out the September option at the same time, on August 21. If you don’t do that and keep that position on until it expires, the risk profile changes, and becomes unlimited.

So, you would buy the September 930 put back at one point when the August contract expires worthless. If you had originally bought the August put at 20 points, and sell the September put, you gain 17 points. That’s a net loss of 3 points, or $150. You incur a loss, but the name of the game as a trader is to keep losses small and manageable so you can find another opportunity, not let them wipe you out. If you had instead decided to do the bearish put spread in August only, buying the August 970 put and selling the August 930 put, you’d lose 12 points, or $600. So with the calendar spread, you can see how you are able to unwind the position with a smaller loss.

Those are the two different scenarios I ran among many outcomes. Remember, the S&P moves in quarter points, so there are many price points the market could settle at on August 21. If you are interested in this type of strategy, we can go into more detail. And, if you don’t agree with me that the market is due for a pullback, you can use a similar type of strategy that would benefit from a bullish outcome.

The name of the game is risk management. Whether you are bull or bear, if you are managing the risk properly on your trades, you’ll be around to trade another day. Certainly these strategies aren’t suitable for all traders, but if you’d like to learn more, I can share some more ideas and strategies with you in this and other markets. Please don’t hesitate to give me a call.

Mike Sabo is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. He can be reached at 800-798-7671 or via email at msabo@lind-waldock.com. Follow Mike on Twitter at msabo@lind-waldock.com. Follow Mike on Twitter at www.twitter.com/LWMSabo.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Futures trading involves substantial risk of loss and is not suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.