Commodities have been a major story in 2011 and silver has outperformed all commodities this year except cotton entering this week. For many investors, silver has been the precious metal of choice to hedge against inflation – for others, a safety trade against global risk with upside potential.

This morning silver futures touched $41.97 an ounce, the highest level since January 1980 when futures traded to $50.35; however, for traders looking to short silver or take profits, the most important number to watch this morning had to be $41.

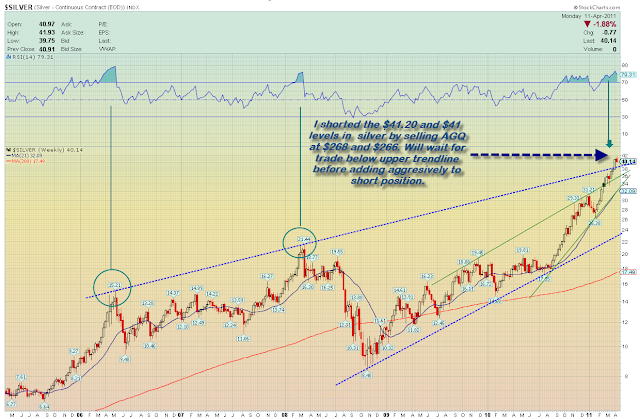

When you look at silver futures on the weekly chart, last week’s high print was $40.96 and this week futures opened at $41. With the precious metal futures touching $41.97 before 2am EST, then pulling back to $41.20 by 8am EST, a short set-up presented itself as a trade thru the $41 level would mean a tail and red bar on the weekly chart.

Why is weekly bar so important? Enter the 5-year long-term rising wedge pattern (blue trendlines) in silver…

Disclaimer: I tried the same trade 2 weeks ago around $38 and the weekly bar didn’t stay red, so I want to make sure silver stays red for week and trades below its upper trendline before aggressively selling more. But here are more reasons, why I am looking short…

A Short Seller’s case:

From the chart…

-Oversold RSI on weekly chart has been a telling indicator in silver

-Measured move completed… $14 move from late July to January 2011, $5 pullback from late Jan. to early Feb. A $14 second move takes silver from $26.38 to $40.40 area

– 2-year rising wedge (green trendline) looks exhausted after a parabolic moves takes silver above the upper trendline of the 5-year pattern

From outside sources…

-According to ZeroHedge, Goldman Sachs closed their long commodity positions…

“We are closing our CCCP basket trade, first recommended on December 1, 2010, for a gain of roughly 25% against our 28% target. This recommendation was premised on our belief that Crude Oil, Copper, Cotton/Soybeans and Platinum remain the key structurally supply-constrained markets. “

– A trader bet nearly $1 million that the silver ETF, iShares Silver Trust (NYSE:SLV), will plunge 37 percent by July

That last point wasn’t a compelling reason at all, but in case my short silver trade via the ProShares Ultra Silver ETF (NYSE:AGQ) is wrong, well misery loves company.

*DISCLOSURE: Ogo is short AGQ

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.