Analysts have been all over the map about the fate of the U.S. dollar. Some predict its value should surge sharply higher against a field of weaker currencies in a debt-ridden world; others contend there is no way for the dollar to go but down as huge amounts of vapor dollars due to various stimulus programs dilute the dollar’s value and could lead to high inflation rates.

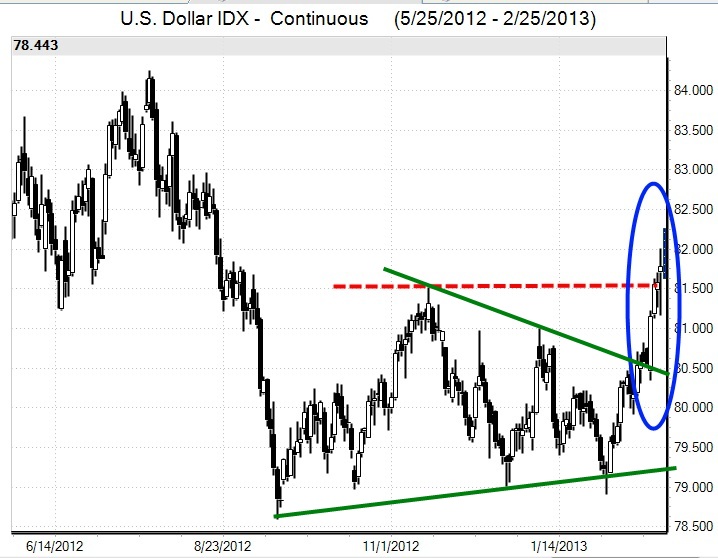

But here is how the U.S. Dollar Index (USDX) chart looks, breaking out to the upside of a triangle (green lines) and above the mid-November high in the 81.50 area (red dashed line).

Source: VantagePoint Intermarket Analysis Software (www.TraderTech.com)

Is the U.S. dollar making a statement? Is it ready for something big or is the recent rally just another of the periodic spurts it has experienced while trolling in generally sideways ranges for several years? No one knows for sure, of course, but the dollar may be bullying itself back onto traders’ radar screens with the breakout as newcomers are attracted to the opportunities in the forex market.

They will have plenty of issues to consider. I don’t think I have ever written any articles or presented any webinars about currencies that haven’t focused on “uncertain conditions” – the always present questions about U.S. and global economic growth, Middle East tensions, nuclear threats (Iran, North Korea) . . . the beat goes on.

Fundamental factors of the past such as trade balances, gross domestic product, money flows, etc. seem to have given way to debt excesses and their ramifications. Perhaps the dominant theme currently in forex markets that does not appear to be uncertain but could ultimately have an uncertain outcome is the path of government and central bank intervention and manipulation in the currency markets.

Switzerland has pegged its franc to the euro. The United States continues to create dollars out of thin air with Treasury purchases and other stimulus programs. The European Union decided to take the same stimulus route last year. Japan has been following similar footsteps since the election of Shinzo Abe, driving down the value of the yen. Every country wants to lower its interest rates, stimulate its economy and weaken its currency to stay competitive in today’s world markets.

Analysts have described the competition as “currency wars,” but in the polite and proper world of central bankers, no one will criticize another nation’s actions because that might call attention to their own policies. The consensus is that the situation will end badly, just like the stock, housing and debt bubbles. The question is how long the free-money house of cards will last before collapsing, not just for the U.S. dollar but other paper money as well.

With that backdrop, newcomers may be wondering how to get started in forex trading. Most forex trading occurs on the “interbank” market among large banks and institutions, but individual traders can trade currencies as futures and options on exchanges or spot markets at cash forex firms. Some features of forex markets that beginners should know:

- All currency trades are spreads – that is, long one currency and short another. Buy the stronger, sell the weaker.

- There are dozens of currency combinations or “pairs”, but much of the forex trading focuses on the “majors” involving the U.S. dollar vs. six other major currencies: Euro, British pound, Swiss franc, Canadian dollar, Australian dollar, Japanese yen.

- “Cross rates” involve currencies other than the U.S. dollar – the euro vs. the British pound, for example – and offer opportunities beyond the dollar.

- Price quoting conventions depend on where the currencies are trading. The euro/U.S. dollar pair, for example, may be quoted as EUR/USD or as USD/EUR.

- Price changes may be quoted in “pips” (percentage in point), a minimum fluctuation in currency exchange rates.

- The U.S. Dollar Index (USDX) compares the U.S. dollar against a basket of other currencies, heavily weighted to the euro. USDX futures are traded at the Intercontinental Exchange (ICE) with an average daily volume around 30,000-40,000 contracts.

- Most currency futures trading involves currency pairs at CME Group. The most active is the EUR/USD pair, which averages about 300,000-400,000 contracts per day. Some currency futures also have options available.

- Exchange advantages: Standardized contracts, centralized marketplace, many bids/asks from thousands of participants, backing for every trade.

- Exchange disadvantages: Most contracts are rather large and require larger security deposits (margin). For example, the full-size euro contract is 125,000 euros, making one pip $12.50 and requiring an initial deposit of $2,475. (CME Group also offers micro futures one-tenth the size of the main contract – 12,500 euros with the value of a pip of $1.25 and a minimum deposit of $248. However, other than the euro, volume in micro futures is not sufficient for liquidity.)

- Cash forex firm advantages: Generally smaller account size requirements, always a quote available at some bid/ask price, prices available on firm trading platforms, no commissions, no volume issues.

- Cash forex firm disadvantages: Only one source, the firm, for bid/ask prices, spreads may be wide, the firm knows the trader’s position, the integrity of some cash firms has been suspect in the past with a number of firms involved in run-ins with regulators, requiring greater due diligence in choosing a firm.

- In short, know your volume in trading currency futures or options and know your firm when dealing in the cash market.

= = =

Read recent forex trading ideas here: