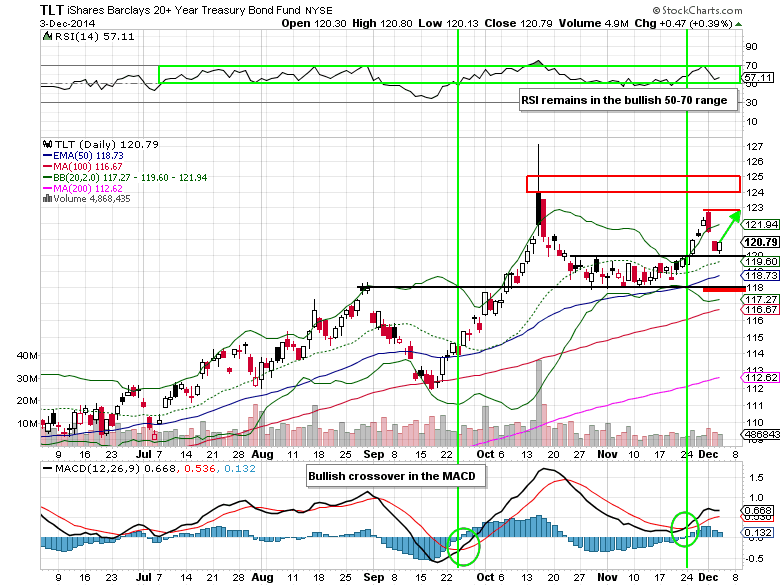

Throughout 2014, trading U.S. bonds via the ETF, iShares Barclays 20+ Year Bond Fund (TLT), has been my go-to trade of the year. Following the breakout above the $105 level in the first quarter, the TLT has gone on to outperform the SPDR S&P 500 ETF Trust (SPY) by 7.73% year to date, even after the end of the Federal Reserve’s quantitative easing program this fall and the various Wall Street forecasts calling for the U.S. 10-year Treasury yield to rise to 3.40%+ (currently 2.29%).

The TLT is now offering another low-risk entry point on the recent pullback to the $120 support level. For a three-week stretch in October and November, the TLT was stuck in a $2 consolidation range between $118 and $120. On November 25th, it finally broke out above the prior resistance level at $120 and went on to run to $122.81 before putting in a short-term top on December 1st.

In a text book case of a stock or an ETF seeing prior resistance turn into current support, the TLT traded within 13 cents of $120 before closing out December 3rd near the highs of the session. An initial stop-loss can now be placed just under the $118 level to effectively manage risk on a new bullish trade in the TLT.

On the same day as the key reversal, more than 4,300 Jan 17 2015 $120 calls traded, making it by the far the single most active option. The majority of these calls were purchased for $2.00-$2.12 each. These call buyers have a breakeven of $122+ over the next six weeks.

The Trade

- Buy the (TLT) Jan 17 2015 $117 calls for $4.15 or better

- Stop loss reference- A move below the $118 level

- 1st upside target- The December 1st highs of $122.81 in the ETF

- 2nd upside target- $124-$125 in the ETF

Notes: By buying the $117 calls (or even deeper in the money calls) you have a delta of 0.74 (a $1 move in the TLT results a $0.74 move in the option) with a theta of -0.01 (daily time decay in the option).

Disclosure: I’m long the TLT Jan 17 2015 $117 calls for $4.10 each.

#####

For more information on options trading, click here.