It was stock which is basic holding stone for many retirement funds in UK and all over to earn steady yieldings.

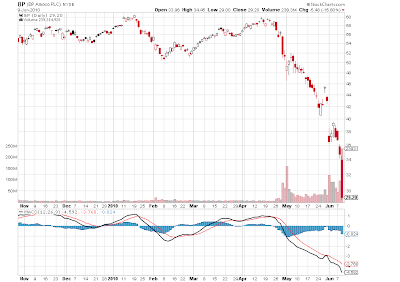

Big stops program hit today, it is now down well over -50% in less that 5 weeks.

Oil and Energy indursty is nowdays more interesting as SPX. Once reason is that when you read them you get clue that this market does not believe for any kind of inflation anymore to become.

SPX retraced up 50% today, stuggled on there some time on there with bearish harmony pattern together with currencies (ie. aud-usd 61.8% etc.) and started new plunge from there. It is possible we just opened new impulse wave for next week from here. If that´s the case, SPX 1040 could give it up next time we will test it.

Very occasionally in the market over the summer, basically I take only one trade per day, either with EU or US hours.