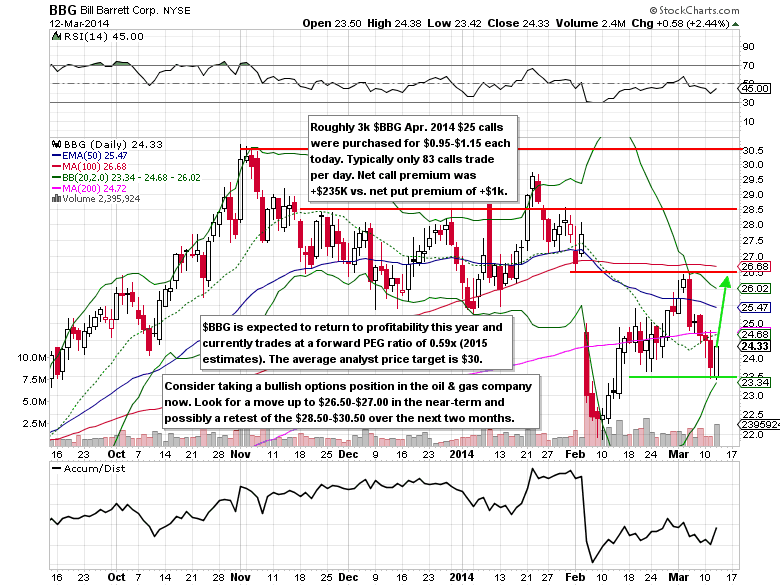

Shares of the oil and gas company, Bill Barrett (BBG), are currently down 9.15% year to date. Bill Barrett is expected to return to profitability this year and trades at a forward PEG ratio of 0.59x (2015 estimates). The average analyst price target is $30. On February 20, Q4 EPS came in at $0.11 vs. the -$0.04 estimate.

UNUSUAL OPTIONS ACTIVITY

On Wednesday, March 12, more than 3,000 Apr $25 calls were purchased for $0.95-$1.15 each. On average, only 83 calls trade per day (40x the average). Net call premium was +$235K vs. net put premium of +$1K. This helped send implied volatility up 7% to 45.86.

TECHNICAL ANALYSIS

Following the large upside call buying, Bill Barrett shares put in a short-term bottom on the daily chart. The first level of resistance to watch for is $26.50-$27.00 in the short-term and then $28.50-$30.50 over the next two months. The reward/risk ratio on the long side is 3:1 at current levels.

OPTIONS TRADE IDEA

Buy the Apr $25 call for $1.15 or better

Stop loss- None

1st upside target- $2.00

2nd upside target- $3.00

Disclosure: I’m long the Apr $25 calls for $1.13 each.

= = =

Mitchell’s Free Trade of the Day featuring Tesla Motors (TSLA)