By: Brandon Rowley

Any subscriber to T3Live.com knows that we love to trade opening gaps in the market. Gaps often create great opportunity in volatile markets. Trading for an opening gap fill has long been a strategy among active short-term traders on any given day. Obviously, many days the gaps are relatively small and, therefore, do not offer much opportunity. But, on days with larger opening gaps in the market, a prominent short-term strategy is to fade the gap. The data from 2009 confirm this concept as a legitimate strategy with a significantly better-than-breakeven probability of success.

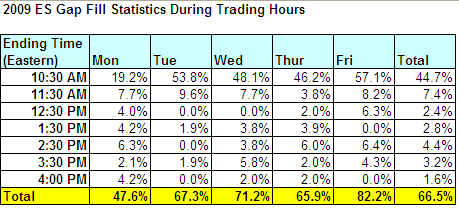

Based on Trade Flight Plan’s study, trading for a gap fill every day in 2009 would have had a success rate of 66.5%. Friday’s session filled the gap in 2009 far more often than Monday’s, an interesting dynamic. The lower likelihood of a gap fill on Monday is probably a result of the more valid adjustment of prices from untraded weekend events. A greater number of events must be accounted for in the opening Monday prices, seemingly making those prices somewhat more reliable.

At T3Live.com we often look for opening gap fills within the first hour. We teach that if the gap is left unfilled after the first hour, typically the market will trend in the direction of the gap. This continuation strategy is the most effective when trading larger gaps (roughly greater than 1%). Based on the chart, out of the 66.5% of the days that the gap is filled, 2/3 of the time it happens in the first hour of trading. This supports the effectiveness of the T3Live strategy throughout 2009. We will continue using this strategy throughout 2010 and beyond especially as I see the markets becoming much more rangebound in the future.

Notes: Trade Flight Plan calculated gap fills from the E-mini S&P 500 futures from 9:30 to 4:00 (not the 4:15 futures closing time). The gap fill is defined by price action that touches or breaks through the closing price of the previous trading day.