Gold continues to push to new record highs, and the chart of gold chart is looking parabolic. It looks tempting to come in and try to sell this market, but it’s been tough to pick a top. I think gold will continue its bull run into the new year, and silver and coffee are two other markets I think also have good upside potential.

The extremely dovish stance of the Federal Reserve has helped drive commodities up as the U.S. dollar remains weak. Fed officials have been indicating we could be looking at the possibility of low interest rates even into 2012. St. Louis Federal Reserve President James Bullard said on Sunday, November 15, that to help the economic recovery, the central bank should extend its mortgage-related asset purchase program beyond its planned end date.

Treasury Secretary Geithner has recently also discussed the possibility of another stimulus package down the road. The idea that monetary policy will remain loose and the government will continue to try to spend its way out of recession, the U.S. dollar should continue to slide, and commodities should continue benefit into 2010. We should continue to see a flight-to-quality into gold, and also silver.

It sounds simple, but for now I recommend traders look to buy gold on dips. Pay attention to intraday support levels and utilize a 5- to 10-percent stop, depending on your risk tolerance. If you are long, you might consider selling out of the money calls as a hedge. If you are long gold from $1,160 an ounce, for example, you could sell a February 1225 call.

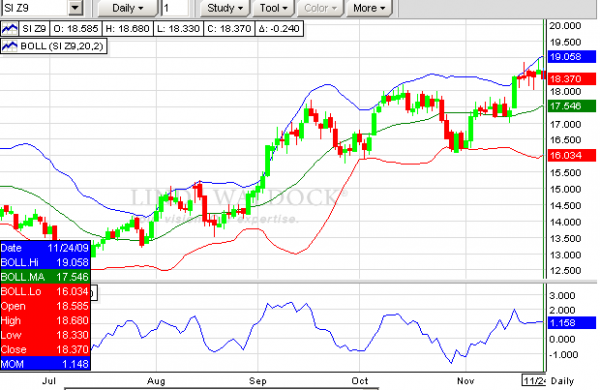

Silver is still below its all-time high by about $3 – $4. In 2008, silver reached $22 an ounce. The main reason silver is lagging is that unlike gold, silver has industrial uses, which have been affected by the recession. However, I think an uptick in the economy in the next few months should push silver above $22.

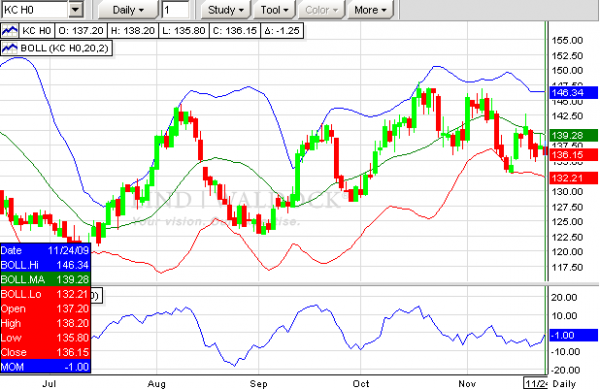

Coffee

Coffee looks to have good upside potential. I’m recommending a call spread in this market; buying the 145 to 150 March 2010 call spread for about 170 points, roughly $650 per spread. This market has the ability to move, especially if the U.S. dollar continues to slide. Looking at a daily chart of March futures, I see $1.50 per pound and a test of highs from June. If coffee futures are above $1.50 in mid-February, when options expire, that would give you a potential profit of $1,875 per spread, not including your commission costs. Your risk is defined as $650 per spread.

John Caruso is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. He can be reached at 800-445-0567 or via email at jcaruso@lind-waldock.com.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

You can hear market commentary from Lind-Waldock market strategists through our weekly Lind Plus Markets on the Move webinars, as well as online seminars on other topics of interest to traders. These interactive, live webinars are free to attend. Go to www.lind-waldock.com/events to sign up. Lind-Waldock also offers other educational resources to help your learn more about futures trading, including free simulated trading. Visit www.lind-waldock.com.

Futures trading involves substantial risk of loss and is not be suitable for all investors. © 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.