I promised this quick follow-on study to the DV-2 indicator analysis (CSS Analytics) for our subscribers about a week ago. However, I believe it makes some important points for my regular readers as well — so here it is. As a refresher, here is the introductory article I posted on the indicator at Market Rewind. This study note compares simple alternatives to trading the unbounded statistic as-is.

Alternate Systems

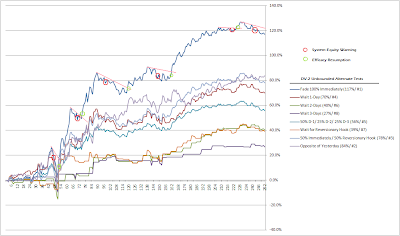

As you will recall, the most basic DV-2 system is to fade the daily signal at the close (go-long negative results; go-short positive results). Here, I looked at six alternatives to the basic system, including: 1) waiting for additional days of signal, 2) waiting for a reversionary ‘hook’ back towards the mean, and 3) leg-in variations on the two. Also, I compared the raw system results with the ultimate reversion system, merely trading the opposite direction of the prior day’s close. Clearly, such on and off-systems will perform best for methods that experience sustained moves.

As shown above, the raw system actually performed the best (117% Simple Return, Rank #1), adding significant alpha to just trading the opposite side (84% Return, Rank #2), or any of the alternatives, for that matter. While the first conclusion is key in determining model value, the second was a bit of a surprise. The reason I believe this to be the case, is that the system is so sensitive and short-term oriented, that it cannot capitalize on delayed entries like less frequent reversion swing methods with more aggressive exit targets. Basically, you are always better going all-in on the first trigger.

Indeed, the next best performer (other than just taking the opposite of yesterday’s trade), was to trade 50% immediately, then the other 50% of available capital the first day the indicator began to come back to the zero line and holding until it did so (78% Return, Rank #3). However, the severity of draw-downs were somewhat mitigated by this later method, which brings up the next major section on “knowing your trading environment.”

When to Trade the DV-2 (or any) System

In the introductory article reference above, some of the key take-aways were:

- Know what environment you are trading in (reverting/ trending).

- Trading methods themselves revert (addition by David V.).

- Track your methodology’s equity curve like it was a stock.

Here, I collapse those all into point three. My first method for the visually inclined, was to effectively “hide” the right-hand side of my charts and scroll forward, looking for either extreme reversals or lower-low patterns in the equity curve. When the system appeared to be breaking down, I drew a trend line off the lower highs. Scrolling ahead, I then looked for either an upward break of that line, or a pattern of higher-lows and higher-highs. In the brief period of time reviewed, note that three of the five instances “turned the system back on” at higher equity levels. However, there is something to be said for sleeping well at night!

In this regard, the second method overlays a Parabolic Switch And Reverse (PSAR) indicator onto the equity curve (and there again, limitless variations are possible). Using that mechanical overlay to turn the DV-2 system on and off, about 80% of gains were preserved while avoiding extended draw-down periods. Due to the extreme whip-saw reversal early last year, using the PSAR to actually reverse signals was not effective. On a longer-time frame; however, I strongly suspect it would have been. Clearly, systems with extended performance epochs will do best with off-on overlays like this.