The Chicago Board Options Exchange Volatility Index (VIX) is a measure of the implied volatility of S&P 500 index options. It considers the options prices (nearest to expiry) observed in the market, and calculates the volatility implied by those various prices using the Black Sholes model. It is commonly called the “fear index” in the financial press for its use as a gauge of investor sentiment about the stock market.

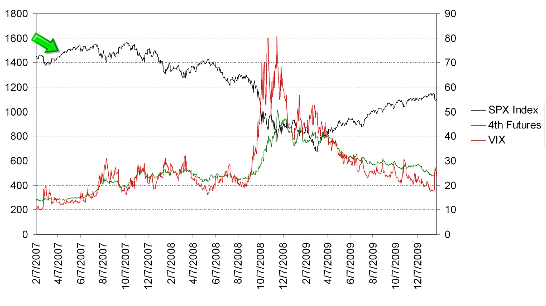

Options writers will price volatility, and that’s essentially the number that’s in the index. Currently, the VIX is trading around 25, seeing its biggest surge since 2007 during the past few sessions. On the chart below, the red line represents the VIX, the black line with the green arrow pointer is the S&P 500 index, and the green line is the fourth-month-out futures contract. That’s the futures contract trading four months away from expiry (currently the May delivery).

As you can see, the VIX and the S&P 500 are inversely correlated. Taking an historical perspective, from 1990 to 2004, a one percent decrease in the S&P 500 was accompanied by a 4.26 percent average increase in the VIX, while a one percent increase in the S&P 500 was accompanied by a 2.3 percent decrease in the VIX. This makes it a great hedging tool for investors with well diversified portfolios, or for speculators to try and predict where the market may go next.

VIX Futures

If you believe volatility will increase or decrease, you can trade that view through VIX futures. This contract is based on real-time prices of options on the S&P 500 index, listed on the CBOE. It is designed to reflect investors’ consensus view of future (30-day) expected stock market volatility.

Contract size: $1,000 times the index

Symbol: VX

Final settlement date is 30 days prior to the 3rd Friday of the following month

Cash settled

One contract would be worth $25,000 with the VIX priced at 25

Minimum Margin $6,000 (subject to change)

Visit www.cfe.cboe.com for more information about this product, including more detailed contract specifications.

As you can see by the chart, the VIX and the VIX futures don’t trade in lockstep. The VIX spiked as the stock market plunged in 2008, but the move in the VIX futures contracts trading four months wasn’t as dramatic. That demonstrated that traders really didn’t believe volatility would remain high for an extended period.

At this time, VIX futures prices show that traders are betting volatility will increase. We can see how at the far right of the chart, the futures contract is priced higher than the VIX. Futures are trading at a premium because market participants expect the VIX to rise, and therefore, volatility in the stock market will increase. Confidence in the S&P 500 is waning, and this indicates there could be a further decline coming. There is still a lot of uncertainty in the market, and we could see more hiccups in the global economy this year. At least, that’s what VIX futures seem to be telling us.

Please feel free to give us a call with any questions you have about the markets, and to develop customized trading strategies based on your views.

Drew Shaw and David Berglas are Market Strategists based in Toronto with Lind-Waldock, a division of MF Global Canada Co. They are accepting Canadian clients and can be reached at 877-840-5333 or via email at dshaw@lind-waldock.com and dberglas@lind-waldock.com.

The data and comments provided above are for information purposes only and must not be construed as an indication or guarantee of any kind of what the future performance of the concerned markets will be. While the information in this publication cannot be guaranteed, it was obtained from sources believed to be reliable. Futures and Forex trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Please carefully consider your financial condition prior to making any investments. Not to be construed as solicitation.

MF Global Canada Co. is a member of the Investment Industry Regulatory Organization of Canada and Canadian Investor Protection Fund.

Futures Brokers, Commodity Brokers and Online Futures Trading . 123 Front St. West, Suite 1601, Toronto, Ontario M5J 2M2.

© 2010 MF Global Holdings Ltd. Lind-Waldock, a division of MF Global Canada Co. Toll-free 877-501-5463. Lind-Waldock promises never to sell your information to anyone.