By: Scott Redler

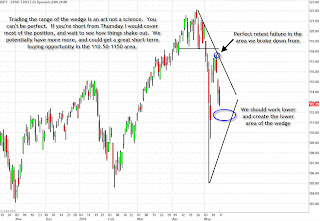

Since the uptrend broke in the S&P we’ve had the luxury to trade the new volatility in this market. Thursday we began to tier in short as we saw a push-through failure and the top side of the expected wedge pattern was formed.

We built a nice position short and covering in this 113 range makes sense. This way you can be clear-minded if we get a nice trade mid-week into the 110-111.50 range in the SPY. The lower end of the wedge should be formed in the coming days, and could create a small snap back long opportunity. But for now we are still in the midst of a correction and there is no need to buy for anything more than a trade.