By: Zev Spiro

Basic materials names were hit hard yesterday with many closing below their 50-day simple moving averages. Weakness was especially visible in Oil and Gas related names. Below is a short idea in Transocean Ltd. (RIG), followed by a long in Warnaco Group Inc. (WRC), which recorded the highest daily close in it’s history yesterday.

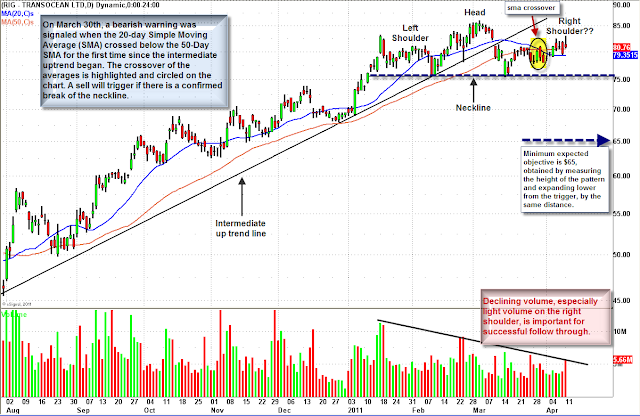

Chart 1: In March the rising trend line was broken, ending the intermediate uptrend in RIG. On March 30th, a bearish warning was signaled when the 20-day Simple Moving Average (SMA) crossed below the 50-Day SMA for the first time since the intermediate uptrend began. A potential bearish head and shoulders pattern is forming, which will trigger with a confirmed break of the neckline. Trigger: confirmed break of the neckline, at $75.50. Target: minimum expected price objective is 65 dollars, measured by the height of the pattern. Protective Stops: may trigger on a confirmed move back above the neckline.

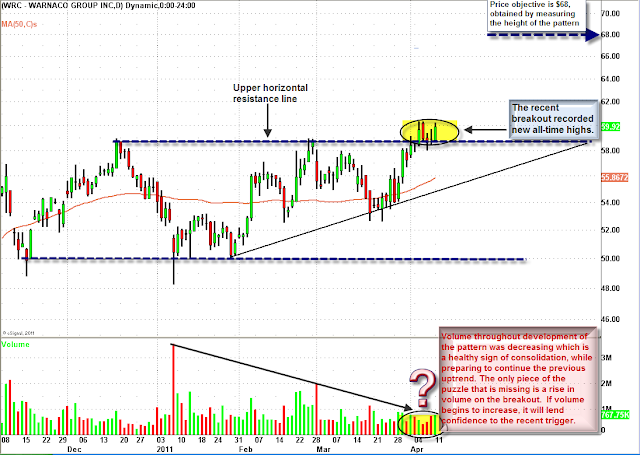

WRC recently broke out of a long consolidation period that began in October. The consolidation formed either a rectangle pattern, or an ascending triangle pattern, both having the same implications and price objectives. There was a lack of volume on the breakout, therefore, an increase of volume will add confidence to the recent trigger.

Chart 2: The daily chart below illustrates the recent breakout in relative strength of WRC versus SPDR S&P 500 Trust (SPY).

Chart 3: The daily chart below outlines the breakout of the pattern leading to all-time new highs. Target: $68 is the minimum expected price objective, obtained by measuring the height of the pattern and expanding higher from the trigger, by the same distance. Protective Stops: may trigger on a confirmed close below $58.

If you are interested in receiving Zev Spiro’s market letter, please email zevspiro@oripsllc.com subject “T3”

*DISCLOSURE: No relevant position-subject to change

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.