Treasury prices have seen some rallies in June and July and are up in the wake of Federal Reserve Chairman Ben Bernanke’s July 21 testimony to Congress, but overall, I see the longer-term trend as bearish. Look to sell Treasury bond futures as investors gain confidence in riskier assets.

Stocks and commodities have been on the rise this year, and it seems clear investors and traders have recently been seeking out riskier assets as confidence in the economy’s prospects improves. Treasury bonds, which investors turn to as a safe haven during uncertain times, are being put on the backburner. Given the magnitude of government spending, people are also getting worried about the prospect of inflation, which is bearish for Treasury bonds. Treasury prices trade inversely to their yield. If inflation is rising, your real returns (reflected in your bond’s coupon payment) will decline.

The yield curve represents the rates of bonds of the same quality but at different maturities. It typically steepens when investors anticipate economic expansion and demand more compensation for longer maturities because of the risk of inflation. The yield curve steepened 25 basis points last week, the most since the period ended May 22, according to Bloomberg.

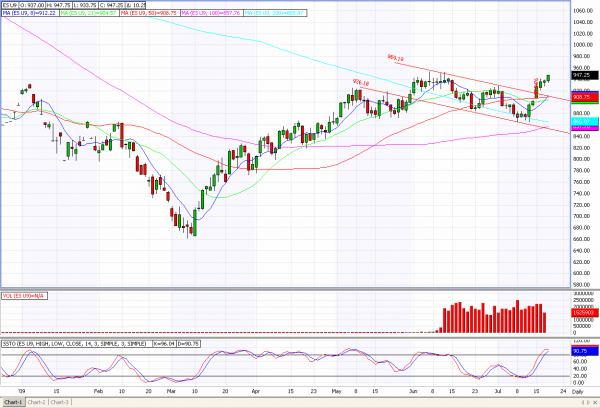

Investors seem to be growing more confident in the stock market. The S&P 500 has broken out of a channel, and has challenged its 2009 highs. It’s clear some of the latest quarterly earnings coming from major Fortune 500 companies have provided optimism. Coming into this week, 71 percent of Standard & Poor’s 500 companies had surpassed earnings expectations for the most recent quarterly reporting period, ahead of the long-term average of 61 percent, according to data compiled by Thomson Reuters. This week is another important one for earnings, with 143 companies in the S&P 500 reporting results.

Treasury bond futures prices have been falling this year as yields have been dramatically rising. The Obama administration plans to borrow large amounts of money to cover large budget deficits. The Chinese, Russians and other central banks willing to take on our debt and lend us money to finance our social programs are demanding higher interest rates to take that risk on. After the dismal employment report released on July 2, we saw a rally in Treasury bond prices and the September futures rose above 121. To me, it looked like short-covering and not the start of a bullish trend. Traders are now waiting to see if the Federal Reserve may provide additional direction.

In his testimony to Congress on Tuesday, July 21, Federal Reserve Chairman Ben Bernanke said the economy is showing “tentative signs of stabilization,” but the Fed intends to maintain a “highly accommodative” monetary policy for “an extended period.”

“The pace of decline appears to have slowed significantly,” Bernanke said today in semi-annual testimony before the House Financial Services Committee. At the same time, “in light of the substantial economic slack and limited inflation pressures, monetary policy remains focused on fostering economic recovery,” he said.

Treasury bonds have been able to rally in early July, but they were not able to hold sustainable, significant resistance levels, leading me to believe the downward phrase this market has been in this year will reestablish itself. I don’t think any bounce related to Bernanke’s latest comments will hold in the longer-term trend.

For those that like to trade aggressively, I recommend looking to short September Treasury bond futures around 117 and use 121 as your stop. The swing low near 111 -16 made in mid-June seems like a good downside target.

The market hasn’t made much headway in the past few sessions and prices seem to be in favor of premium buyers. Implied volatility on many options is a bit lower, giving traders the ability to buy premium at a little less than theoretical value. Premium sellers should probably wait for more volatility. There are many ways you could look to trade the short side; your capital, risk-tolerance and goals will ultimately determine your strategy. Please feel free to give me a call to discuss your particular situation.

Tim Evans is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. He can be reached at 800-798-7671 or via email at tevans@lind-waldock.com

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Futures trading involves substantial risk of loss and is not suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.