Moving up today (pre-market) on no real news but rumors that CHINA! will provide some kind of stimulus (more cash for clunkers was the early story) but both our Futures and European stocks pared gains after China’s Xinhua News Agency said the country has no plan to introduce stimulus measures on the scale deployed during the financial crisis in response to this year’s economic slowdown.

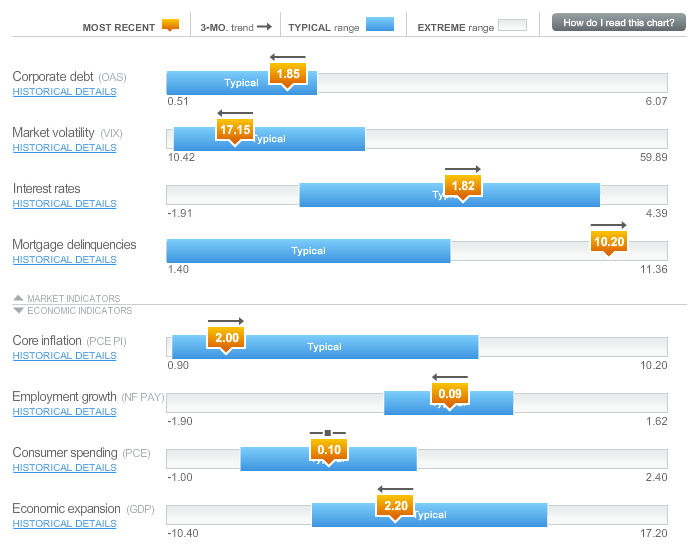

As you can see from Russell’s Economic Dashboard, as of 4/30 the US was in a fairly typical range. Our worst performing indicator, Mortgage Delinquencies, have actually come down a bit since this report so again, it’s hard to be bearish on US Equities – especially when one considers the question – compared to what?

Spanish Retail Sales were off 9.8% from last year, which is 50% worse than the 6.3% expected by Economorons and a 164% increase over the 3.7% pace they were dropping at the month before (March). Moody’s is warning that A LEAST a quarter of 254 unrated European LBO deals with debts totaling $168Bn could default because of refinancing burdens exacerbated by the eurozone debt crisis. The refinancing peak will hit in 2014-2015, and new-issuer pricing will remain costly.

Spanish Retail Sales were off 9.8% from last year, which is 50% worse than the 6.3% expected by Economorons and a 164% increase over the 3.7% pace they were dropping at the month before (March). Moody’s is warning that A LEAST a quarter of 254 unrated European LBO deals with debts totaling $168Bn could default because of refinancing burdens exacerbated by the eurozone debt crisis. The refinancing peak will hit in 2014-2015, and new-issuer pricing will remain costly.

“Over half the debt maturing through 2015 is concentrated in 36 companies, each of which has over EUR1 billion of debt,” said Chetan Modi, head of Moody’s European leveraged finance. “While this debt is broadly dispersed across industries, there is a concentration of debt to be refinanced in 2014.”

And these companies are now one year closer to the 2014-2015 refinancing peak, which is worrisome given the weak macroeconomic environment and generally low credit quality of the debt. Many bigger companies will seek to refinance via high-yield bonds, but will need to be “sufficiently creditworthy” to do this, and the openness of European and U.S. high-yield markets will determine how these companies can navigate the refinancing burden. Moody’s said market access will likely remain in “windows,” and it expects new-issuer pricing to remain costly.

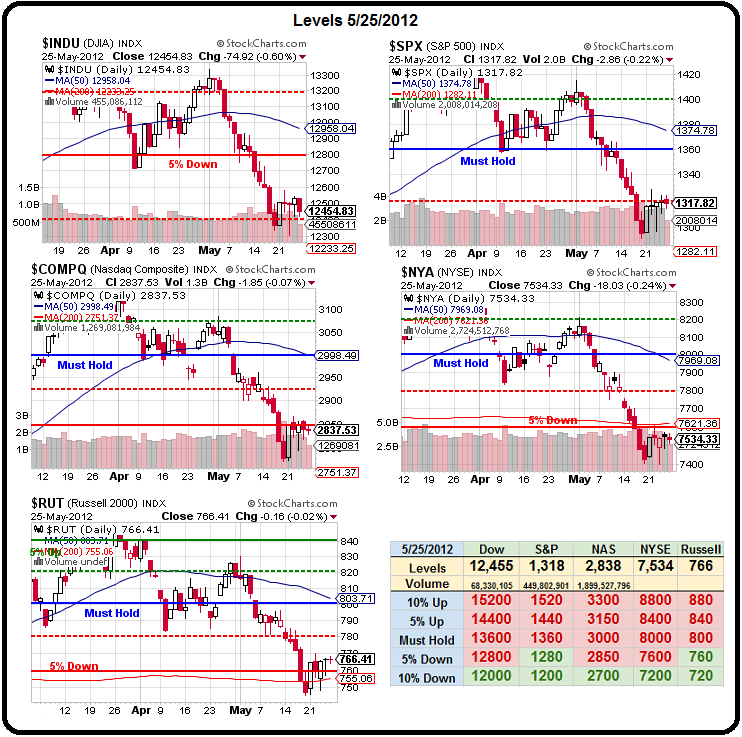

Although we went into the weekend bullish in our short-term portfolios and we’re ready to dip our toes in the water long-term again by setting up a brand new virtual $500,000 Income Portfolio – we remain Cashy and Cautious until we see some proper progress over our strong bounce levels and, so far, we’re still waiting to…

Although we went into the weekend bullish in our short-term portfolios and we’re ready to dip our toes in the water long-term again by setting up a brand new virtual $500,000 Income Portfolio – we remain Cashy and Cautious until we see some proper progress over our strong bounce levels and, so far, we’re still waiting to…