$800Bn.

$800Bn.

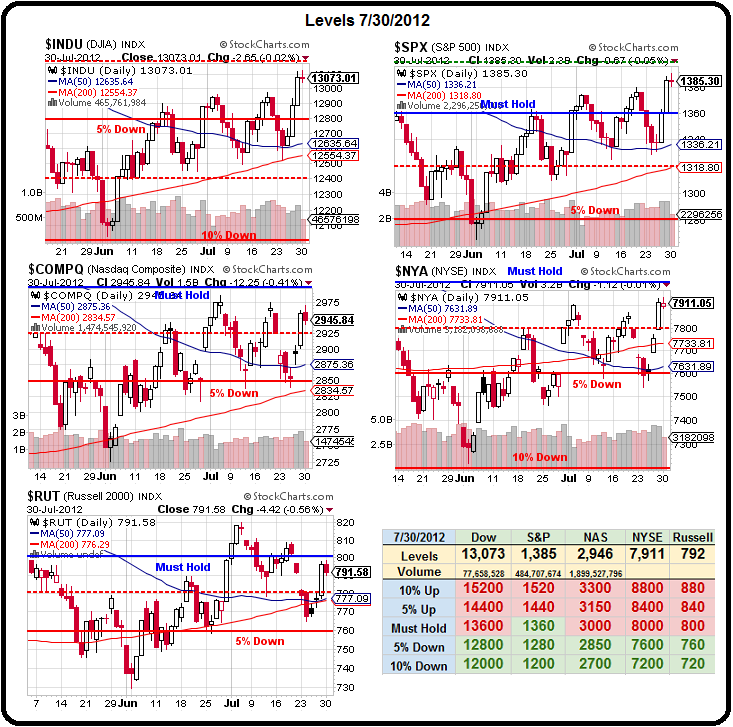

That’s the number we came up with yesterday for the minimum bailout/stimulus required to hold Dow 13,000, S&P 1,380, Nasdaq 2,950, NYSE 7,900 and Russell 790. Buying a breakout over those levels will be even more expensive and, so far, we’ve gotten a grand total of ZERO actual commitments from the Central Banksters and other Government morons, most of whom are on vacation anyway.

As you can see from our Big Chart, this is within our rule of thumb that it costs $10Bn to buy an S&P point and that effect lasts for about 6 months. The S&P is up 105 points off the June lows and, so far, only China has committed stimulus Dollars (about $120Bn down with $400Bn still rumored), leaving a the gap to be filled by Europe, Japan and the US.

Of course China has, by far, the biggest hole to fill. In fact, Larry McDonald calls China’s GDP “the new Libor,” pointing out the pretty obvious fact that it makes no sense at all that Europe has negative growth while the US and Japan have minimal growth while China claims things are humming along at 8.5%.

Just this morning, Taiwan (China’s neighbor) reported declining GDP, Korea reported their Industrial Production has gone negative and Singapore’s Government Investment Corporation issued a report with a very gloomy outlook for the whole planet, stating:

“The developed economies will continue to be weighed down by an extended period of debt-deleveraging. In Europe, the debt crisis has spread beyond the periphery to the larger Spanish and Italian economies, In the United States, the fragile economic recovery could be aborted by automatic spending cuts and tax increases if political gridlock continues beyond the 2012 elections with no compromise on a long-term plan for reducing the public deficit. Growth in the emerging economies, particularly China, is also slowing.”

Well, that sums it up quite nicely, doesn’t it? Meanwhile, everyone is looking for the ESM to save us but Germany hasn’t even approved the fund yet – that matter is tied up in their Constitutional Court (pictured left) until September 12th and you can bet those judges are on vacation and not sitting in Draghi’s kitchen, plotting to spring an early approval on us on Thursday – as seems to be expected by the MSM.

Well, that sums it up quite nicely, doesn’t it? Meanwhile, everyone is looking for the ESM to save us but Germany hasn’t even approved the fund yet – that matter is tied up in their Constitutional Court (pictured left) until September 12th and you can bet those judges are on vacation and not sitting in Draghi’s kitchen, plotting to spring an early approval on us on Thursday – as seems to be expected by the MSM.