Here we go again!

Here we go again!

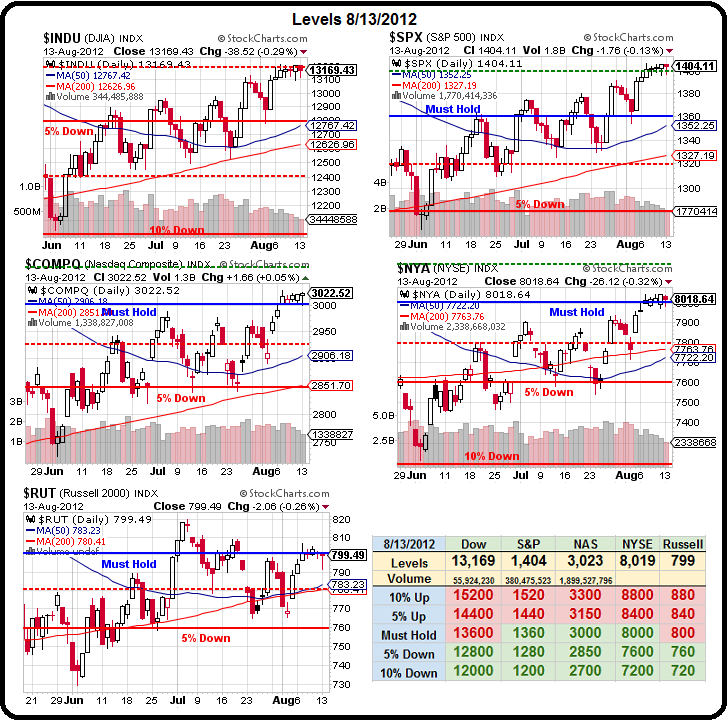

Last Tuesday we also had a big run-up in the Futures and I was skeptical, writing “Through the Roof or Smashed into a Thousand Pieces.” Two stocks we did like that morning were SBUX and ABX – and both did quite well this past week but we have generally turned more bearish since then as we languish along the top of our range (see Big Chart).

Yesterday, we adjusted our breakout levels to account for the weaker Dollar to Dow 13,464, S&P 1,428, Nasdaq 3,060, NYSE 8,160 and Russell 816. If we do manage to break over 3 of these 5 lines and hold them for a day – it will be time to switch off our brains and run with the bulls. Since we are currently about 2/3 bearish – that means we’ll need a few aggressive upside hedges to protect our bear positions – from Central Banksters printing money or MSM pundits promising the same….

Making money in a bull market is pretty easy. My top trade remains FAS, which is a 3x bullish tracking index of XLF. We are already long Financials in our FAS Money Portfolio but, as a new trade, you can play XLF to move up to $16.50 (up 10%), which should roughly give us a 30% increase in FAS (now $93) to $120 and that means that the Oct $105/115 bull call spread at $2 could return 500% at $10. That’s a nice, simple trade with no margin requirement too.

If you do have spare margin, you can sell any put from our Twice in a Lifetime list (mentioned in yesterday’s post). One trade idea we added more recently was selling BBY 2014 $18 puts for $3.25, which is a net $14.75 entry on BBY (now $19.50) and what we really like about selling BBY is that buy-out offer on the table – if that goes through and it’s over $15 (supposedly $25), then the short puts cancel like an early Christmas gift. You can apply that cash to 1x or 2x the bull spread – if you buy 2x the spreads for $4 and sell 1x the puts for $3.25, then you are in $20 worth of FAS bullish spreads for net .75 with a 2,566% potential upside to the cash (there is about $5 of margin on the short puts).