Watchlist: PCAR WAT CVH JEC COH JAZZ CHKP PCX OLN

Market Structure: Choppy-Open ~ My watchlist had an equal number of stocks gapping up and down. Most of the morning, at most one or two stocks were trading outside of their range, through at one point around 11:15am, more than half of them were breakdowning but they have recovered as of this writing. With such an opening, fading extremes with a bias toward shorting strength was the ideal type of set up to play.

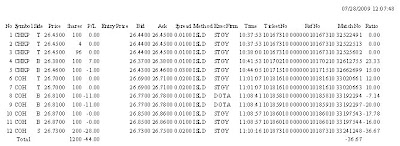

| Stock | Shares | Side | Gross | Fee | Net | Set-up | Actual |

| COH | 400 | Flip | -50 | -6.49 | -56.49 | Flip | Mixed |

| CHKP | 200 | Short | $6 | -2.85 | $3.15 | Top Fade | Top Fade |

| -$53.34 |

All morning I hesi-traded, not entering set-ups even though my analysis seemed to be panning out. I passed on shorting PCAR and JAZZ on morning highs. Finally entered CHKP but had too tight of stop and took a partial profit of under a dime. Missed an .80 move down as a consequence. COH was a brain lapse where I lost all inhibition (that was constraining me early). The main problem was I entered and exited the position twice WHILE I was on a work conference call. Just stupid. I ended up buying and selling on the wrong end of the range it was in…

While today was disappointing, I lost $50 in one stupid split second decision on COH that was a lapse of discipline counter to the rest of the morning. However, my trading limits (3 a day) is helping preventing it becoming a greater loss and another blow-out day.

I need to enter the good set-ups based on the day’s market structure, not chase entries, put the stop orders in, and follow the exit rules.

Very simple stuff. Back at it tomorrow.