BHP offered to pay $38.4Bn for POT this morning.

BHP offered to pay $38.4Bn for POT this morning.

Is BHP high or is this market seriously undervalued? Well, for one thing, POT turned them down saying the offer($130/share – CASH) “substantially undervalues PotashCorp and fails to reflect both the value of our premier position in a strategically vital industry and our unparalleled future growth prospects.” CEO Dallas Howe continues: “We believe it is critical for our shareholders to be aware of this aggressive attempt to acquire their company for significantly less than its intrinsic value. The fertilizer industry is emerging from the recent global economic downturn, and we feel strongly that PotashCorp shareholders should benefit from the current and potential value of the Company. We believe the BHP Billiton proposal is an opportunistic effort to transfer that value to its own shareholders.”

Considering POT closed at $112 yesterday, so a 16% pop in the offer but POT was at $85 at the beginning of July and hasn’t been over $130 since the 2008 crash, although they did top out at $239.35 so I suppose a very patient investor could imagine that within 5 years, $200 is not an unreasonable goal. Still, is that enough reason to turn down $130 of cash now, with the proverbial 1.3 birds in the hand being worth 2 in the bush?

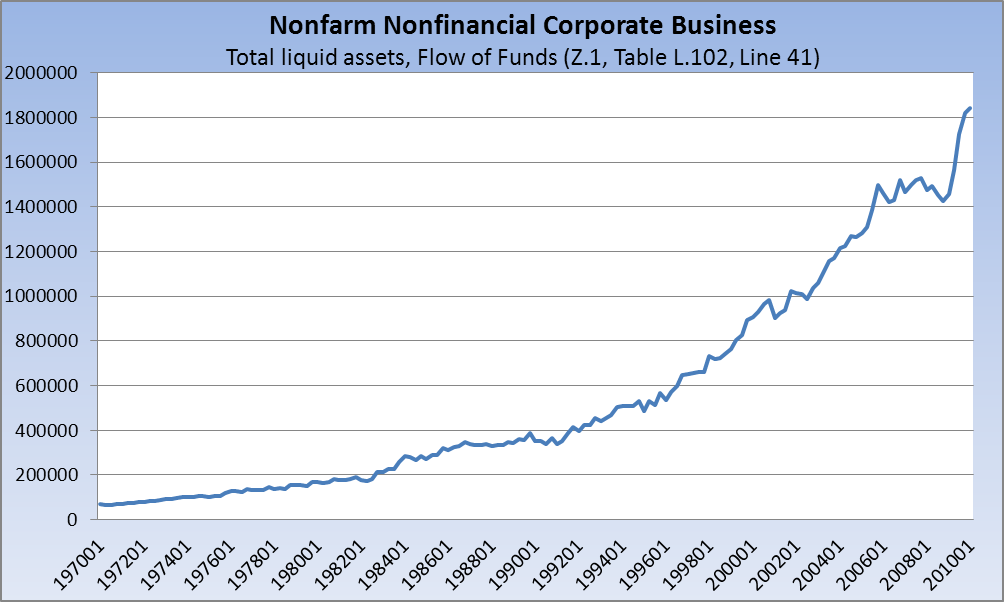

Back on July 12th (when POT was trading at $92.81 and the Dow was at 10,200) my premise for looking for S&P 1,100 and Dow 10,700 was that Corporate America’s Non-Financial companies were sitting on a $2Tn pile of cash and, as an old M&A consultant, it seemed pretty obvious to me what was going to happen to that money.

Back on July 12th (when POT was trading at $92.81 and the Dow was at 10,200) my premise for looking for S&P 1,100 and Dow 10,700 was that Corporate America’s Non-Financial companies were sitting on a $2Tn pile of cash and, as an old M&A consultant, it seemed pretty obvious to me what was going to happen to that money.

We’ve had plenty of M&A activity recently. In fact, M&A activity in the first half of 2010 saw 5,345 deals (up 49% from last year), the highest level since 2007, indicating that companies are INCREASING their confidence in the economy despite the BS spin you are getting from politicos who NEED you to believe things are worse than they seem and the MSM, who push fear like heroin to create a NEED for their product.

POT’s board of directors is very confident that they don’t NEED BHP’s money and BHP may NEED POT badly enough to want to sweeten the deal – frankly I’m surprised at the timing because I would have waited for another dip and the fact that BHP (one of the World’s largest resource companies with $50Bn in annual sales) didn’t think they could wait indicates to me that they see the overall…