For the foreseeable future, I think the U.S. dollar will remain weak. That being the case, as an investor, there are some interesting currency strategies you can pursue. Canada and Australia are economies driven by natural resources, and should see their currencies strengthen as the weak U.S. dollar makes the case for a commodity run.

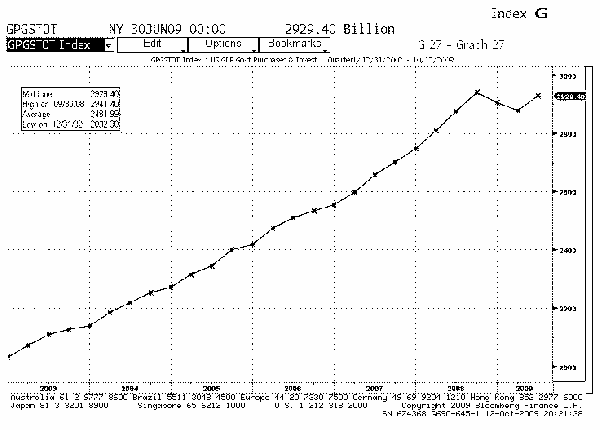

As we all know, a recession means less money for the government in the form of tax dollars, because fewer people are working and business is retracting. However, you’d never know it by the level of government purchases we’ve seen, which are at record levels. It’s fine to have government purchases high, as they go to defense, roads, subsidies and so forth, but a country has to be able to afford them.

Government Purchases

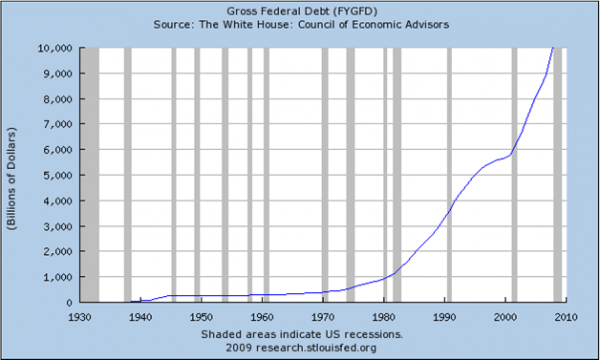

In the U.S., Federal debt is at a record of about $10 trillion and doesn’t appear to be coming down anytime soon. The country is going to have to pay for these debts, with interest. Increasing the money supply is one way to do it, by offering Treasuries at near-zero rates and by printing money. This is economics 101. The money supply is up tremendously, but demand for the U.S. currency isn’t up nearly as much. Whenever supply is greater than demand, your good goes down in price—in this case, the good is the U.S. dollar.

U.S. Federal Debt

There was a headline in the Wall Street Journal on October 9, 2009, that said, “U.S, Stands by as Dollar Falls.” Why would the U.S. encourage a weak dollar policy? In my opinion, because it’s working. Exports are going up, and imports are going down. The balance of payments in the states is getting back to levels seen at the turn of the century. You have to get the economy back to a place where it can accelerate, and the weak-dollar policy seems to be doing that. I think we will see a continued weak U.S. dollar for the next six months, at least until we can get through these tough times.

U.S. Balance of Payments

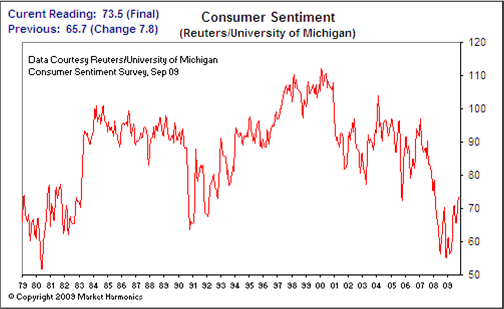

To get an indication on the economy from the ground level, we can look at consumer sentiment. Recent consumer sentiment polls show consumers still have concerns about the economy and the future outlook. The latest Reuters/University of Michigan survey was at 73.5. Although sentiment has been rising, the number is still low compared with the historical outlook, and shows consumers still have concerns.

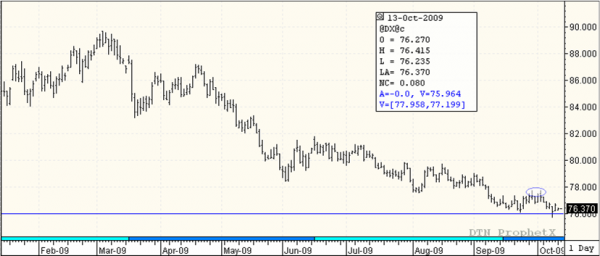

One way investors can capitalize on trends in the dollar is by trading the ICE U.S. Dollar Index, which represents the dollar’s standing against a basket of six global currencies: the euro, yen, pound sterling, Canadian dollar, Swedish krona and Swiss franc. If you take a short position in the dollar index futures, you are going long this basket of currencies against the U.S. dollar. The contract is heavily weighted in the euro (57.6 percent), but you do get a diversified approach if you have an opinion on the dollar in general and would like to speculate on it.

Looking at the chart of the U.S. Dollar Index, since the start of the year, it’s clearly gone down. Looking to August and September of 2008, there was support right around where the index is currently trading, 76. Technically, that support should become future resistance when the market drops.

U.S. Dollar Index

I see the dollar index futures breaking through 76 and heading to 73 – 71, where the market was in March and April 2008. Looking at the chart in a more recent time period, the break doesn’t seem to show a lot of authority. We need a close beneath 76 to bring a move to 71. There was a double top on the chart (circled) near 77.75, in September – October. A close above that level would cause me to seriously reconsider this strategy. There are always factors that could boost the U.S. dollar, but you have to look at the big picture. The U.S. seems to be better off right now with a weaker currency; it allows them to get their house back in order, to get the markets back on track. I think the Federal Reserve is likely to sit back and watch the dollar weaken, until the economy recovers.

U.S. Dollar Index

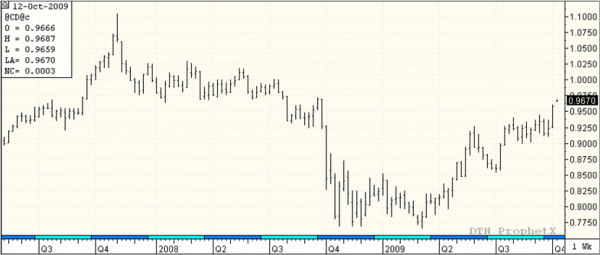

Prospects for the Canadian dollar look more bullish, and you could also consider a long position in CME Canada dollar futures. In contrast to the U.S., which is still losing jobs, Canada’s latest employment report was positive. In September, 30,000+ jobs were created and about 20,000 were in the manufacturing sector. There are skeptics that don’t think Canada can maintain these manufacturing gains. But because Canada is a commodity-driven economy, unless there is a slowdown in China or the Asian region (lessening demand for raw materials), a pullback in Canada’s currency shouldn’t occur, except perhaps on a temporary basis. I see the Canada dollar at par before the end of the year.

The Bank of Canada has already lowered interest rates as far as they can go, so it will be hard for it to weaken the currency. I don’t see any outlets to do that. I think the dollar is likely to be near the par range until at least we get out of recession. Canada is going to have to live with it, and hope companies can become more efficient to compete on a global scale.

The outlook for the Australian dollar looks similar to that of the Canadian dollar, both being commodity-based economies. Australia’s unemployment rate is under 6 percent, and the nation’s central bank recently raised interest rates. It looks like another rate hike may be coming in November. For the Aussie dollar, a move to 94 – 96 cents seems likely before year-end.

Canada Dollar

The euro has seen a strong uptrend since the start of the year, and it’s not necessarily because the euro region has been spectacular. But as long as the U.S. dollar remains weak, the euro should benefit, and I think the euro should get to the mid- to-high $1.50 range by the end of the year.

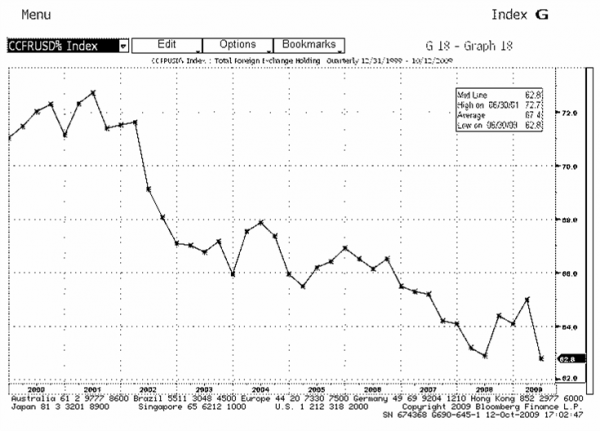

A compelling reason to be bullish the euro can be seen in the World Central Bank Index. Central banks have been consistently holding fewer and fewer U.S. dollars. In 2001, the holdings dominated in U.S. dollars were up to about 73 percent. Right now, that figure is at 63 percent. The euro is becoming a very comfortable currency in the eyes of the international community. It’s now been around 10 years, and they trust it. I think we’ll see the trend continue, and demand will increase for the euro currency and decrease for the U.S. dollar.

World Central Bank Index

Yen

Japan has seen fantastic economic numbers recently. It’s been beating the U.S. in nearly every way possible. However, the yen seems to have run up too fast. Analysts are calling it 10 to 15 percent overvalued. I think we will see a further pullback in the yen, or at least a consolidation, until the U.S. dollar weakens more. I don’t see 114 on the horizon just yet.

Drew Shaw is a Junior Market Strategist based in Toronto with Lind-Waldock, a division of MF Global Canada Co. Drew is accepting Canadian clients can be reached at 877-840-5333 or via email at dshaw@lind-waldock.com.

The data and comments provided above are for information purposes only and must not be construed as an indication or guarantee of any kind of what the future performance of the concerned markets will be. While the information in this publication cannot be guaranteed, it was obtained from sources believed to be reliable. Futures and Forex trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Please carefully consider your financial condition prior to making any investments. Not to be construed as solicitation.

©2009 MF Global Ltd. Lind-Waldock, a division of MF Global Canada Co. Toll-free 877-501-5463. MF Global Canada Co. is a member of the Canadian Investor Protection Fund.

Futures Brokers, Commodity Brokers and Online Futures Trading.

123 Front St. West, Suite 1601, Toronto, Ontario M5J 2M2