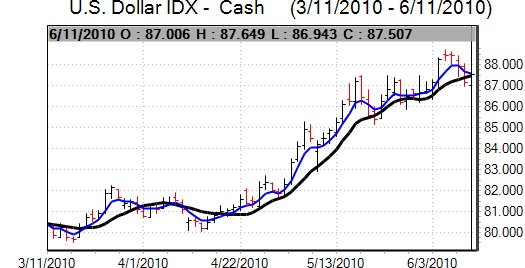

EUR/USD

The Euro found support close to 1.22 against the dollar on Thursday and then strengthened gradually during the European session.

There was further relief surrounding the European tender results which eased fears surrounding the Euro-zone financial sector and also helped underpin the Euro. There are still very important underlying structural vulnerabilities which could derail the currency.

The US economic data was weaker than expected with jobless claims rising to 472,000 from a revised 459,000 previously. The ISM index for the manufacturing sector declined to 56.2 from 59.7 the previous month. There was a sharp decline in the prices component while the employment index held comfortably above the 50 level.

There was also a sharp 30% decline in pending home sales for May with sales weakened by the ending of tax credits. The data overall will maintain expectations over a slowdown in the economy during the second half of 2010. There will also be additional speculation that the Federal Reserve will need to take additional measures to support the economy.

In contrast to recent sessions, the dollar failed to gain any significant support when risk appetite deteriorated as demand for the currency was sapped by falling yield support. The Euro pushed higher in the US session and there were further gains as stop-losses were triggered. In volatile trading, the Euro pushed to a 6-week high just above 1.25 against the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

China’s PMI data recorded a significant slowdown for June with the HSBC measure dipping to near the 50 level and this provided some further yen protection on renewed fears over fresh deterioration in the global economy. There were greater reservations over carry trades which curbed any selling pressure on the yen.

Domestically, the headline Tankan business confidence index strengthened to +1 for the quarter from -14 previously and this was the strongest figure for 2 years. The data should provide some degree of yen support even though there were still reservations over the capital spending outlook. The dollar weakened to test support below 88.20 following the Chinese economic data.

The dollar remained under pressure during the US session as weaker than expected US data and Wall Street losses further undermined yield support. The US currency dipped to fresh 8-week lows just below 87 before finding some degree of support.

Sterling

Sterling found further support close to 1.4870 against the dollar on Thursday and strengthened steadily during the day.

Domestically, the PMI index for the manufacturing sector edged lower to 57.5 for June from 58 the previous month which will maintain expectations over a slowdown, but there will be relief that the series held relatively firm. The Bank of England credit conditions survey was mixed with improved credit for individuals offset by weaker corporate lending.

Bank of England MPC member Miles stated that the time was not yet right for higher interest rates, maintaining the slightly more dovish tone seen over the past few days. Expectations surrounding interest rates are liable to fluctuate considerably during the next few weeks and this is also liable to maintain Sterling volatility.

The US currency came under heavy selling pressure during New York trading on Thursday and this pushed the UK currency to a high just above 1.5160 against the US dollar. Sterling found support close to 0.8260 against the Euro.

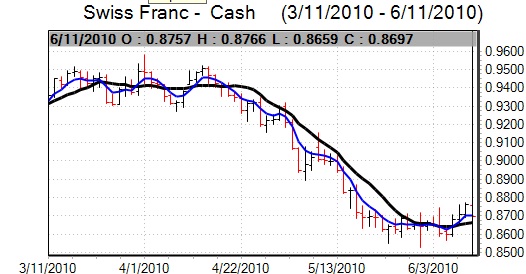

Swiss franc

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

The dollar was unable to make headway during European trading on Thursday and was subjected to renewed selling pressure during the day. With wider losses for the US currency, there was a low close to 1.06 against the franc which was the lowest dollar level for 10 weeks. The Euro found support below 1.32 against the franc and strengthened to 1.3260.

The Swiss currency still gathered support from a deterioration in risk appetite, although a stabilisation in sentiment surrounding the Euro-zone banking sector did help curb fresh franc buying support.

Australian dollar

Australian dollar volatility remained high on Thursday and there was further selling pressure following weaker than expected Chinese PMI data. Domestically, there was also a decline in building approvals which undermined sentiment while the retail sales data was subdued. Hopes for a mining-sector deal provided some relief, but there was still an Australian dollar low around 0.8315 against the US currency before a partial recovery.

A reversal in the US currency helped push the Australian dollar back to the 0.8430 area in New York, but weak equity markets capped the currency’s advance.