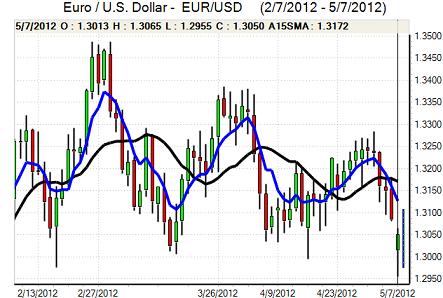

EUR/USD

The Euro was unable to gain any significant support from the weaker than expected US payroll report on Friday with an employment increase of 115,000 for April from a revised 154,000 for March as selling pressure on the currency resumed with unease ahead of key weekend events.

Political comments dominated over the weekend and into Monday’s trading with the French presidential election and Greek parliamentary election. There was no surprise in the French ballot with Socialist Party’s Hollande winning against Sarkozy gaining around 52% of the vote.

There were uncertainties surrounding domestic economic policies given resistance to austerity measures and proposals to increase taxes. There were also important Euro-zone uncertainties given that the Franco-German relationship under Merkel and Sarkozy was a key influence on policy. There will be calls for Germany to reverse course and France will also put additional pressure for more aggressive action from the ECB.

The governing Greek coalition parties lost substantial support at the election with particularly heavy losses for Pasok. New Democracy won the most number of seats and won first chance at forming a government, but was unable to gain sufficient backing. The majority of Greeks still want to retain the Euro, but there is also strong opposition to austerity measures and there will be major difficulties resolving this contradiction. Prolonged uncertainty will increase fears surrounding a forced exit from the Euro and wider Euro-zone uncertainty.

Attention on the US economy has been diverted by the Euro-zone drama, but there will be fresh speculation over an economic slowdown which will also maintain uncertainties surrounding Federal Reserve policies. Comments from Fed officials will remain an important focus during the week while sentiment was boosted by a strong reading for consumer credit.

The Euro was subjected to heavy selling pressure at the Asian open on Monday and dipped to lows near 1.2950 before rebounding back to the 1.3050 region as risk appetite staged a recovery, but sentiment remained generally fragile.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar came under fresh selling pressure following the US payroll data on Friday with a retreat to support levels below 80 against the yen.

There was fresh selling pressure on the currency as risk appetite deteriorated following the European political developments on Monday with a low close to the 79.60 region while the Euro fell very sharply to below 104.

There were no major developments as Japanese markets re-opened following the Golden Week holidays. There will still be speculation that the Finance Ministry will put additional pressure on the Bank of Japan to relax monetary policy further and this curbed speculative yen buying while Finance Minister Azumi warned against speculative moves with the dollar edging back to the 80 area.

Sterling

Sterling hit resistance close to 1.62 against the dollar on Friday and retreated to lows near 1.61. The decline continued to reflect underlying US gains rather than any Sterling weakness as the Euro remained firmly on the defensive as Sterling pushed to highs near 0.8050.

There was a lack of fresh domestic incentives, especially with the UK markets closed for a holiday on Monday. There was further speculation that there would be defensive inflows into the UK currency due to fresh Euro-zone stresses.

In this environment, there was a reduced focus on UK fundamentals, but there would still be the potential for markets to lose confidence given the underlying vulnerability and deficit pressures. The latest RICS housing survey weakened to -19% for April from -10% previously, maintaining unease over the housing outlook with Sterling capped below 1.62.

Swiss franc

The dollar found support in the 0.9120 area against the US currency on Friday and rallied to the 0.9180 region. The US currency spiked higher in Asia on Monday with highs above 0.9250 before a slow descent to the 0.92 area. The Euro was again trapped within narrow ranges and unable to break significantly away from the 1.2010 level.

Swiss consumer prices rose 0.1% for April compared with expectations of a 0.2% increase with an annual 1.0% decline in prices for the year. The data will maintain some underlying unease over deflationary pressures and pressure for the National Bank to curb any further franc appreciation.

There will be further speculation over defensive capital flows into the Swiss franc given fresh political stresses within the Euro-zone area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar tested support below the 1.02 level against the US currency on Friday following the US payroll data. There was renewed selling pressure in Asian trading on Monday as risk appetite deteriorated sharply.

There was support in the 1.01 region and the currency gained support from a stronger than expected economic data with a sharp 7.4% recovery in building approvals and a stronger than expected 0.9% increase for the latest retail sales data which helped stabilise confidence surrounding the domestic economy. In contrast, the latest trade data was weaker than expected with a AUD1.59bn deficit for April, the third successive deficit which increased unease over trade prospects and the regional economy.