EUR/USD

The Euro hit resistance above1.42 against the dollar in European trading on Tuesday and had a weaker tone during the US session, but selling pressure was contained and it advanced firmly later in the session as support above 1.41 held.

There were further discussions surrounding the Greek debt situation during the day with Euro-group head Juncker among those advocating the possibility of a soft debt restructuring or re-profiling. There were no decisions taken at the ECOFIN meeting and all sides will wait for the forthcoming report on Greece’s compliance with budget austerity measures and targets before making further announcements.

Uncertainty was a negative factor for the Euro, but the impact was measured as a longer-term restructuring has been partially priced in. The headline German ZEW business confidence indicator fell to 3.1 for the latest month from 7.6 while underlying confidence in current conditions remained strong and there were still expectations that the ECB would look to increase interest rates again which sustained yield support for the Euro.

The US economic data was weaker than expected as housing starts fell to an annual rate of 0.52mn for April from a revised 0.59mn previously while permits also dipped. There was no change in industrial production for the month while capacity use also declined. The data did undermine risk appetite which had an initial beneficial impact on the dollar, but the US currency was then undermined against the Euro by a decline in US Treasury yields. The Euro moved above 1.4250 against the dollar in Asian trading on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed to a high of 81.75 against the yen during Tuesday, but it was unable to sustain the gains and retreated back to 81.30 in New York trading. The dollar was undermined by weaker than expected economic data which damaged yield support and it retreated back to near 81.0.

The yen gained some initial support from a deterioration in risk appetite and decline in commodity prices with a reluctance to fund carry trades before risk conditions stabilised later in the US session.

There was still little in the way of enthusiasm for the Japanese economy with sentiment undermined by comments from Bank of Japan Governor Shirakawa that the economy was in a severe state following the earthquake. The economic data reinforced growth fears with a 6.0% monthly decline in the services sector for March and there are strong expectations that Thursday’s data will record a contraction in GDP.

Sterling

The latest UK consumer inflation data was much stronger than expected with the headline rate increasing to a three-year high of 4.5% for April from 4.0% previously and compared with expectations of a 4.2% rate. The core rate also increased to 3.7% for the month and Sterling spiked higher following the release with a peak just above 1.63 against the dollar.

Bank of England Governor King was forced to write another letter to explain why the inflation rate remained outside a 1-3% range and King maintained that the rate was liable to increase further in the near term. He also stated that it would be a mistake to seek to bring inflation down too quickly as this would risk triggering a substantial deterioration in economic conditions.

In testimony to parliament, new MPC member Broadbent has mixed views on monetary policy, but the overall tone was not especially hawkish and the net balance on the committee will now be more dovish which will curtail Sterling support.

The MPC minutes will be watched closely on Wednesday and Sterling will tend to weaken if there were fewer that 3 votes for a rate increase. Sterling retreated to a low below 1.62 against the US currency before rallying as the US currency was subjected to renewed selling. The Euro found support below the 0.87 level.

Swiss franc

The dollar peaked around 0.8880 against the franc during Tuesday and retreated steadily to lows just below 0.88 in late US trading as the dollar was subjected to a wider retreat. The Euro retreated to lows near 1.25 against the Swiss currency before finding support.

Underlying discussion and speculation surrounding a restructuring of Greek debt continued to support the Swiss currency, especially as uncertainty remained at very high levels. The franc also gained initial support from a fresh decline in global equity prices.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

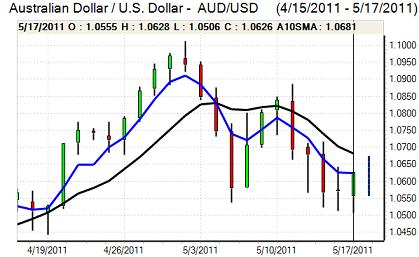

Australian dollar

The Australian dollar was blocked just above 1.06 against the US currency in Europe on Tuesday and retreated sharply to test support at the 1.05 level as global equities and commodity prices were subjected to selling pressure.

There was a decline in consumer confidence according to the latest Westpac sentiment index which had some negative impact on sentiment towards the domestic economy.

There was a tentative improvement in risk appetite and there was also solid buying support on dips which pushed the Australian dollar back to a high above 1.0650.