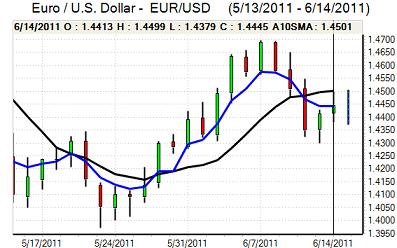

EUR/USD

The Euro found support close to the 1.4410 area on Tuesday and pushed to highs near 1.45 as risk appetite improved, but it was unable to break above this resistance zone as selling increased. The US economic data was slightly stronger than expected with the retail sales decline held to 0.2% for May compared with expectations of a 0.3% fall while there was a 0.3% core increase. The data helped underpin risk appetite which also boosted demand for the Euro as defensive dollar demand eased.

Fed Chairman Bernanke warned that the US AAA credit rating could be at risk if there was no improvement in the fiscal position and underlying confidence in the US fundamentals remained weak

The Greek debt situation remained an extremely important focus during the day as European Finance Ministers leaders battled to find a workable solution in an emergency meeting. The German government continued to insist that private bond-holders would need to accept losses as part of any fresh support package for Greece. The ECB continued to voice strong opposition to any plans of a debt restructuring that would be considered a default by credit ratings. President Trichet was particularly vocal in stating that governments were flirting with what could be an enormous mistake.

Uncertainty will be an important negative factor for the Euro, especially as there were suggestions that any decision on a fresh support package would be delayed until July. In this environment, there will be the persistent risk of capital outflows and a contraction in bank credit which will destabilise the currency. Although Belgium’s credit rating was reaffirmed by Standard & Poor’s, there will also be fears over the contagion threat and the Euro retreated back to the 1.4410 area in Asia on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 80.10 against the yen on Tuesday and rallied sharply to a high near 80.60 following the US economic data releases. There was only a small impact on US Treasury yields, but there was an improvement in risk appetite which helped curb immediate demand for the Japanese currency as equity markets rallied.

Markets also remained wary of fresh G7 intervention to stem yen appreciation with Finance Minister Noda stating that there would be decisive action if markets became disorderly.

The dollar was unable to sustain gains through the 80.60 area with reports of substantial offers and the US currency was also still unsettled by underlying debt fears. There will also be the threat of capital repatriation from the Euro area which will support the Japanese currency.

Sterling

There was some volatility surrounding the latest UK inflation release with a slightly weaker Sterling tone following the data. The headline consumer inflation rate was in line with expectations at 4.5% and unchanged from the previous month while the core rate dipped to 3.3% from 3.7%.

Although remaining substantially above the 2.0% Bank of England target, the data will not trigger additional pressure on the central bank to raise interest rates and this had some negative impact on Sterling as yields remain unattractive at extremely low levels.

Sterling pushed higher following a sharp improvement in the latest Nationwide consumer confidence index to 55 from 44 previously, but there was further selling pressure above the 1.64 level against the dollar.

The UK currency is still gaining some net protection from the Euro-zone sovereign-debt stresses, but a lack of confidence surrounding the UK fundamentals is still dampening Sterling demand.

Swiss franc

The dollar found support close to 0.8350 against the franc on Tuesday and jumped higher to a peak near 0.8450 early in the US session before consolidating just below this level.

There were equally sharp moves on the crosses as the Euro pushed sharply higher to a peak of 1.2250 before a fresh retreat. The evidence suggests that there are a very high number of speculative long franc positions and players are nervous over holding positions at current valuations which is contributing to high volatility for the currency.

There will continue to be unease surrounding the Euro-zone debt stresses which will tend to curb underlying selling pressure on the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

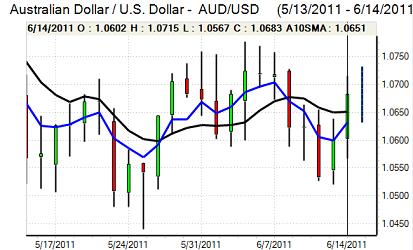

Australian dollar

The Australian dollar found support on dips to the 1.0620 area against the US dollar during Tuesday and rallied to highs just above 1.07 as the currency gained support from an improvement in global risk appetite. Sentiment was still fragile given unease over the risks of a sharp slowdown in the Asian economy which curbed aggressive Australian dollar buying.

The domestic economic data was mixed as an improvement in first-quarter housing starts was offset by a further decline in consumer confidence to a two-year low. Reserve Bank Governor Stevens stated that there were upside risks to underlying inflation over the next few years and stated that further monetary tightening would be required at some point.