EUR/USD

The Euro was blocked in the 1.3450 zone against the dollar on Wednesday and retreated to test support around 1.3360 before again consolidating around 1.34 for a fourth consecutive day as markets were unable to break any major technical levels.

There was a palpable mood of caution surrounding Friday’s EU Summit as aggressive political posturing and negotiation continued. There were generally downbeat comments from German officials with a warning that there was greater pessimism than last week over a potential deal while there was a rejection of speculation that the ESM and EFSF could be run in tandem. France, in contrast, stated that it would not leave the Summit without a powerful political deal.

There were further tensions within the banking sector as funding remained extremely tight. Central banks held their first liquidity auctions since last week’s announcement of lower swap rates and the lower rate triggered a big increase in demand for dollars with over US$50bn in funds for the three-month tender. With Libor rates increasing to 0.54%, the cost of securing liquidity from central banks was only slightly higher than from the market. There were also warnings from the German government that it could force recapitalisation on the banks.

Uncertainty will continue to be a key short-term feature over the next 24 hours. Attention will also focus on the ECB meeting due on Thursday. There are expectations that the central bank will lower interest rates by a further 0.25% to 1.00% and introduce longer-term repo operations. The bank’s task is certainly complicated by the timing of Friday’s EU Summit. Bank President Draghi has effectively promised that there will be additional support for the Euro-zone if there is political agreement on a more robust Euro structure. There will, therefore, be a limit on how much can be promised ahead of the meeting.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any headway against the yen on Wednesday and retreated to lows near 77.60, although ranges remained extremely narrow. Asian equity markets remained generally on the defensive which curbed risk appetite and also limited any selling pressure on the yen as the Euro hit resistance above 104.20.

The Japanese economic data was weaker than expected with a further 6.9% decline in core machinery orders for November following an 8.2% decline previously. The series is volatile, but there will be further concerns surrounding the investment outlook. There was also a decline in eco-watchers index with the current account data not having a significant impact.

There will tend to be some decline in defensive yen demand if there is political deal at Friday’s EU summit, although there will still be underlying caution.

Sterling

Sterling was trapped within narrow ranges ahead of the US open on Wednesday, but did find support in the 1.56 area against the dollar. There was evidence of demand against the Euro as it pushed to a one-month high near 0.8520 and this helped propel the UK currency to highs above 1.57 against the dollar with some reports of merger-related demand.

The latest NIESR estimate was slightly weaker than expected at 0.3% in the three months to November which maintained concerns over the growth outlook, especially as there was a decline in the latest industrial production data.

The Bank of England will announce its latest monetary policy decision on Thursday and the most likely outcome is that the MPC will hold policy steady this month, especially given the high degree of uncertainty surrounding the Euro-zone.

Sterling volatility is liable to increase especially with the ECB also facing key policy decisions on Thursday.

Swiss franc

The dollar found support close to 0.9230 against the franc on Wednesday and pushed sharply higher to a peak just below the 0.93 level while there was also a move to near 1.2440 against the Euro.

There were comments from the Finance Ministry that Switzerland was still considering the possibility of negative interest rates to deter any flows into the Swiss currency. There were also comments that there was a plan to deal with any surge in capital inflows if Euro-zone fears intensify.

There was also further speculation that the National Bank would look to raise the minimum Euro level which continued to curb any franc support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

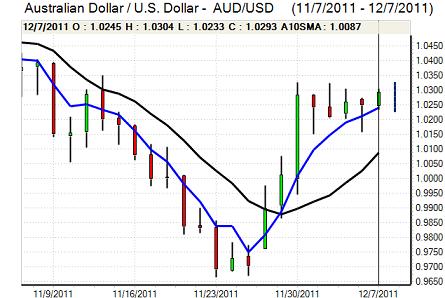

Australian dollar

The Australian dollar found support in the 1.0230 area against the US currency on Wednesday and pushed back to the 1.03 area late in the US session.

The latest labour-market data was weaker than expected with a 6,300 decline in employment for November while unemployment increased to 5.3% from 5.2% and this triggered fresh pressure on the currency, although underlying ranges continued to narrow.

There were further concerns surrounding the regional economy which lessened any buying support for the Australian currency as conviction over moves remained weak.