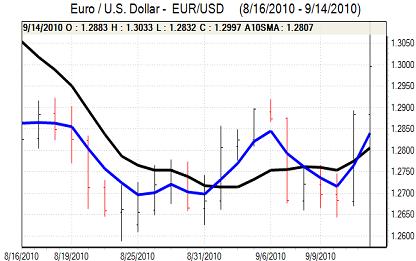

EUR/USD

The dollar’s trade-weighted index was at a 1-month low in Asian trading on Tuesday as underlying buying support remained limited and it remained firmly on the defensive during the day.

The German ZEW business survey index was weaker than expected with a decline to -4.3 for September from 14 the previous month even though the current situation component remained firm while industrial production was unchanged for July. The impact was limited as internal yield spreads narrowed slightly which helped stabilise currency sentiment.

The US retail sales recorded a 0.4% increase for August following a revised 0.3% gain the previous month while underlying sale rose 0.6% for the month. There was a larger than expected increase in business inventories for the latest month which boosted optimism over third-quarter GDP growth even if there is a longer-term negative impact on the growth potential.

The data helped ease fears over a slide into recession for the US economy, but there was still a lack of buying support for the dollar. There was still some speculation that the Federal Reserve would decide on further quantitative easing within the next few months.

The data also tended to improve risk appetite which lessened defensive dollar demand and helped underpin the Euro. The Euro broke above resistance levels just above 1.29 against the dollar and then advanced strongly to a high above 1.30 as there was significant stop-loss dollar selling, consolidating just below 1.30 late in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Finance Minister Noda stated on Tuesday that the authorities were prepared to act decisively if needed, but the comments lacked bite and the dollar tested 15-year lows below 83.30 during the Asian session before finding some buying support.

Prime Minister Kan narrowly won the Democratic Party leadership vote on Tuesday as he defeated rival candidate Ozawa. There were market expectations that Kan would be less likely to back intervention to weaken the yen and this had a significant impact in strengthening the Japanese currency, especially as there was no evidence of G7 support for intervention to weaken the Japanese currency.

The dollar dipped to test fresh 15-year lows below 83 before a marginal recovery following the slightly better than expected US data.

Sterling

The latest UK housing data was weak with the RICS index declining to a 15-month low of -32 for August from -8 which reinforced fears over a sharp slowdown in the sector. Domestic doubts helped push the UK currency back to below 1.54 against the US currency in early Europe on Tuesday.

The latest inflation data was stronger than expected with the headline rate steady at 3.1% for August compared with expectations of a decline to 2.9%. There was also an increase in the underlying rate to 2.8% from 2.6%. The data triggered some speculation that the Bank of England would need to take a tougher line on monetary policy and provided initial Sterling support despite persistent policy doubts.

Bank of England member Weale stated that he was comfortable with the current policy situation. He also stated that the recovery might be slower than expected.

There were reports of institutional Sterling buying which provided support. Sterling moves were influences strongly by dollar moves later in the US session and the UK currency was able to rise strongly with a peak just above 1.5580.

Swiss franc

The Euro found support below 1.29 against the franc during Tuesday and strengthened to the 1.2950 area in the US session as there were wider Euro gains. The US dollar remained under pressure during the session and dipped to lows below 0.9950 during the US session.

There was some decline in defensive demand for the Swiss currency as risk appetite improved, but losses were limited as underlying Swiss demand remained firm.

There was some speculation that the National Bank would increase interest rates at this week’s policy meeting which provided background franc support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

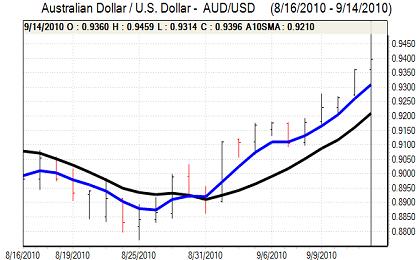

Australian dollar

The Australian dollar dipped slightly lower in the European session, but it held above the 0.93 level against the US currency. The Australian dollar then advanced firmly during the New York session with a peak above 0.9450 which was the highest Australian currency level since 2008.

The Australian currency was boosted by a generally weaker US currency and an improvement in risk appetite as confidence in the global economy improved following recent data releases. Domestically, there was an improvement in the NAB business confidence index which also helped improve sentiment.