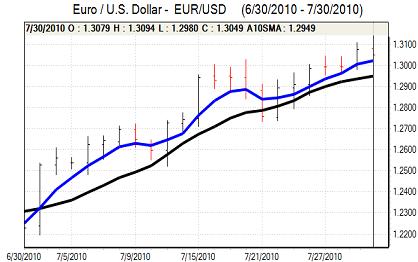

EUR/USD

The Euro continued to correct weaker in European trading on Friday and tested support levels close to 1.30 against the dollar. There were still underlying concerns over the Euro-zone outlook and there were warnings from credit-rating agency Moody’s that Spain’s AAA rating was likely to be downgraded and this curbed Euro support to some extent.

Generally downbeat comments from Regional Fed President Bullard reinforced speculation that the Fed could move towards additional policy easing and this maintained a degree of caution over the US fundamentals and currency which limited the extent of Euro selling.

The US GDP report was slightly weaker than expected with an annualised growth rate of 2.4% for the second quarter from a revised 3.7% the previous quarter. There were positive contributions from investment and housing, but consumer spending slowed while there was less support from inventories.

The data overall maintained expectations of a slowdown in the economy, but markets had priced in a significant slowdown and looked to put a positive gloss on the data. The Chicago PMI index was also stronger than expected with a rise to 62.3 from 59.1 the previous month and this helped provide relief.

Month-end considerations were important and there was significant dollar selling during the US session as underlying support for the currency remained weaker. The Euro found support below the 1.30 level and pushed to a high above 1.3050 later in New York.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The US dollar remained on the defensive during Asian trading on Friday and tested 8-month lows close to 86.25. There was a general mood of caution over risk which provided some degree of underlying yen support, although wider dollar vulnerability also remained important.

The Japanese economic data was generally disappointing with a particular focus on the industrial production data with a 1.5% monthly decline for June. Consumer prices maintained the trend of annual declines in the annual data and there will inevitably be pressure on the Bank of Japan to resist yen appreciation which will tend to curb yen support.

The dollar remained under pressure after the US data and dipped to test support below the 86 level for fresh 2010 lows before finding some degree of respite as risk conditions stabilised.

Sterling

Sterling hit resistance above 1.5650 against the dollar during European trading on Friday and weakened to test support close to 1.5550 where there was solid buying support.

The latest consumer confidence data did not have a major impact with the fifth successive decline, but there will be some degree of unease that the economy could deteriorate over the next few months and this could still have an important impact.

Technical and month-end considerations were important during the New York session with Sterling gaining support on technical grounds following the ability to hold above the 200-day moving average. The UK currency also found month-end support on sustained dollar weakness and pushed to a fresh 5-month high just above 1.57 later in New York

Markets will be on high alert ahead of the Bank of England interest rate decision on Thursday which could trigger further volatility in the early part of the week.

Swiss franc

The dollar was unable to make any significant headway against the franc during Friday and weakened to test support below 1.04 before securing some limited respite. The Euro retreated to weekly lows near 1.35 against the Swiss currency before recovering to 1.3580 later in New York.

The KOF business confidence index was unchanged at 2.23 for July and this will lead to some speculation that economic momentum is slowing. The index is still high in historic terms which will limit the impact and underlying confidence in the economy should remain firm.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

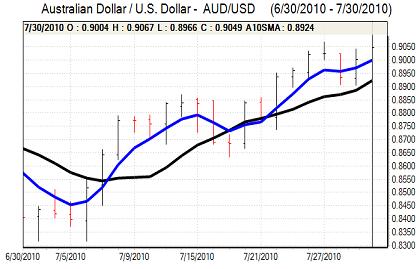

Australian dollar

The Australian dollar found support above 0.8950 against the US dollar on Friday and advanced in US trading as the US currency came under wider selling pressure. The local currency also benefitted from a tentative improvement in risk appetite and renewed interest in high-yield currencies.

There will be reduced expectations of an interest rate increase next week which will tend to dampen Australian dollar sentiment to some extent and unease over the global economy is likely to increase.