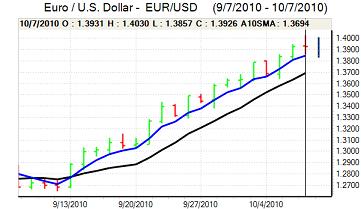

EUR / USD

The Euro tested resistance levels above 1.3950 against the US dollar on Thursday and pushed to a high just above 1.40 for the first time since February as underlying dollar sentiment remained negative. The Euro-zone data was firmer than expected with an increase in German industrial production, although the impact was limited.

The US economic data was slightly stronger than expected with a decline in jobless claims to 445,000 in the latest week from 456,000 the previous week. The figure will boost optimism that there will be an increase in payrolls in the Friday data, but underlying confidence in the economy will remain weak.

The ECB left interest rates on hold at 1.00% and President Trichet’s prepared comments at the following news conference were broadly in line with expectations with comments that policy was appropriate. The rise in market interest rates did not have any policy implications. Trichet also commented that he opposed disorderly currency moves and this will raise some speculation that G7 will look to stabilise currency markets, although he declined to comment on the prospect for co-ordination.

The Euro was vulnerable to profit taking after rapid gains and following a failure to hold above 1.40, the Euro retreated to lows near 1.3850 before securing fresh buying support. The US payroll data will be watched closely on Friday and the dollar will need a robust figure to secure any sustained reversal in sentiment.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

JPY

The US data helped stabilise dollar sentiment, but the US currency was unable to make any significant headway as the Japanese currency gained on the crosses.

Markets will remain on high alert over comments on currency levels and the prospects for policy co-ordination as the IMF and G7 meetings start on Friday. There will be a reluctance to buy the yen aggressively given the possibility of a concerted effort to keep major currencies within ranges.

GBP

Sterling re-tested resistance levels above 1.5920 against the dollar in early Europe on Thursday before being undermined by a much weaker than expected housing report. The Halifax Bank recorded a 3.6% decline in house prices for September, the steepest monthly decline on record, which will increase fears over housing-sector prospects.

There was still firm buying support on dips with a renewed move higher ahead of the Bank of England interest rate decision. The MPC held interest rates at 0.5% and also announced no change in the GBP200bn quantitative easing programme. There had been some speculation over an increase in the bond-buying programme and Sterling pushed higher following the decision with a move to eight-month highs just above 1.60 against the dollar. There was no statement so the vote split or bank bias was not known.

There was tough resistance near this level and the UK currency was also undermined by a technical recovery in the dollar with Sterling consolidating above 1.5850 after a sharp retreat from just above 1.60.

CHF

The dollar dipped to fresh record lows near 0.9550 against the franc on Thursday before finding support and rebounding to a peak around 0.97. There was pressure for a dollar correction following recent losses and the move was enhanced by franc losses on the crosses as it weakened to lows near 1.3490 against the Euro.

There were some rumours that the National Bank was checking prices during the session which tended to undermine the franc. There will still be a fundamental lack of confidence in other major currencies which will limit underlying selling pressure on the franc.