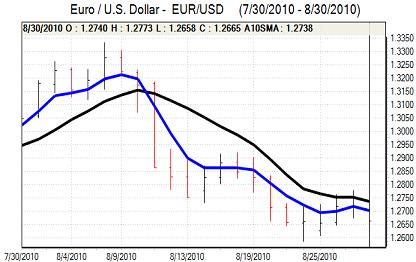

EUR/USD

The Euro was unable to break resistance levels above 1.2750 against the dollar during Monday and drifted weaker, notably in the US session with lows below 1.2680 as buying support faded.

Despite an initially favourable reaction to Fed Chairman Bernanke’s comments on Friday, underlying confidence in the US economy remained weak with further expectations of an underlying slowdown and threat of a renewed slide into recession. There was also a lack of confidence ahead of Friday’s monthly employment report with markets expecting a headline decline in payrolls and a lacklustre underlying increase. The US data released on Monday did not have a significant impact with small gains in personal spending and income.

Wall Street also came under selling pressure during the session which undermined risk appetite and also contributed to some defensive dollar support as US Treasury prices rallied strongly.

There were also persistent doubts surrounding the Euro-zone economies as yield spreads continued to widen following a weaker than expected Italian bond auction result. Sentiment surrounding the Euro is liable to remain generally fragile.

Sentiment deteriorated further in Asian trading on Tuesday with the Euro weakening to below 1.2650 as Asian equity markets came under significant selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan held interest rates at 0.10% following the emergency policy meeting. The central bank did provide additional liquidity within its money-market operations, but the yen still gained ground following the announcement.

It was unlikely that the Bank of Japan would announce more aggressive measures, but there was disappointment at a lack of strong rhetoric against yen strength. From lows beyond 85.80 against the dollar, the yen recovered to the 84.60 region as underlying yen demand remains strong.

Finance Minister Noda did comment on Tuesday that he was ready to take bold action if necessary, but markets, at this stage, will want to see action rather than rhetoric.

The Japanese data was mixed with a higher than expected industrial production increase offset by a weaker PMI reading and confidence in growth prospects remained weak.

Falling stock markets contributed to the deterioration in risk appetite as the Nikkei index fell sharply and the yen strengthened to a high near 84.30 in Asian trading.

Sterling

Sterling was again unable to break above resistance in the 1.5580 region during Monday and drifted weaker during the session with trading volumes curbed by the UK market holiday.

The domestic economic data was stronger than expected with an increase in consumer confidence for August while the Chambers of Commerce also revised up its GDP growth forecasts. Despite the favourable data there will be fears that the economy will deteriorate over the next few months, especially as the housing market remains weaker.

Global risk conditions will continue to play an important role and Sterling will be much more vulnerable to selling pressure when sentiment deteriorates, especially if doubts over the UK banking sector re-surface.

Falling equity markets have been a negative influence over the past 24 hours and Sterling weakened to lows near 1.5450 against the dollar. The PMI manufacturing data will be watched very closely on Wednesday with some optimism that a competitive currency will help trigger a favourable reading.

Swiss franc

The Euro was unable to sustain Friday’s gains during Monday and was subjected to renewed heavy selling pressure. As risk appetite deteriorated, there was renewed defensive demand for the franc and the Euro weakened to fresh record lows below 1.2950.

The dollar was also unable to hold above 1.03 as the franc maintained a generally very strong tone with notable capital inflows. Persistent doubts over the global economy will continue to provide underlying franc support in the near term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

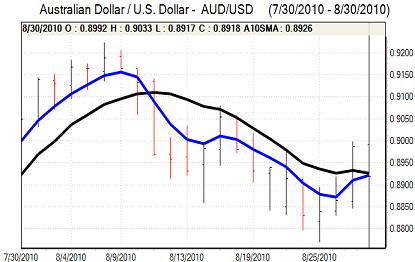

Australian dollar

The Australian dollar was unable to hold above the 0.90 level against the US currency and retreated to lows below 0.8950 during US trading as confidence in the global economy faltered.

Risk appetite remained weaker on Tuesday as stock markets fell, but there was some degree of resilience for the Australian dollar. The domestic data was stronger than expected with a modest increase in retail sales and a larger than expected rebound in building approvals.

Nevertheless, underlying confidence in the Australian and global economy is still liable to weaken which will tend to limit currency support.