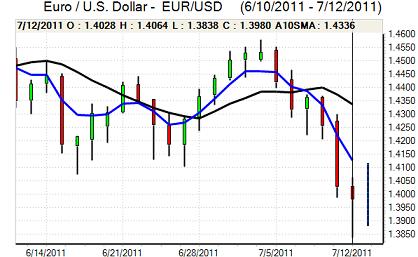

EUR/USD

The Euro came under further heavy selling pressure on Tuesday, retreating to the weakest level since early March below 1.3850 as the Euro-zone debt crisis intensified. There was a fresh surge in peripheral bond yields as Italian benchmark yields briefly increased to above the 6.0% level as panic selling increased. There were also reports that regional Spanish budget deficits were much worse than officially stated which served to further undermine confidence.

There were reports that the ECB was buying EU bonds and there were also reports of strong Chinese interest which helped stabilise confidence with Italian yields returning to below 5.70%. In tandem, the Euro recovered quickly back to the 1.40 area against the dollar.

Underlying confidence remains extremely fragile amid fears that Euro-zone leaders have still not found a long-term solution to the crisis. Italy remains pivotal to the Euro’s future and European leaders will meet again on Friday to discuss the situation with a selective Greek default being mooted. There was a further setback later in the US session as Moody’s downgraded Ireland’s credit rating to junk status.

The US economic developments provided no dollar support for the US dollar. The trade deficit rose to a 30-month high of US$50.2bn from a revised US$43.5bn previously as oil imports rose strongly and there will be a negative impact on US GDP estimates.

The FOMC minutes from June’s meeting reported that there was a high degree of uncertainty over growth and inflation prospects. Exit strategies were discussed in length, but FOMC members also admitted that plans might need to be changed. There was some discussion that further monetary stimulus might be required in the future. As uncertainty prevailed, the dollar consolidated around the 1.40 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar dipped to lows below 80.0 against the yen in European trading on Tuesday and stop-loss selling triggered a decline to the 79.30 area. Volatility remained extremely high and the dollar slumped to fresh lows near 78.50 late in the US session before rebounding to the 79.50 area.

The rapid yen gains inevitably sparked speculation over G7 intervention, especially given that market conditions were increasingly disorderly. Finance Minister Noda stated that currencies were being watched closely and markets will stay on high alert.

The yen continued to gain defensive inflows from a lack of confidence in the Euro-zone and capital repatriation will remain potentially important. There was some relief over the latest Chinese GDP release which bolstered risk appetite slightly in Asia on Wednesday.

Sterling

Sterling was subjected to further downward pressure against the dollar in Europe on Tuesday due to a combination of domestic and international events. There was a further slide in the Euro which triggered initial Sterling losses against the dollar.

The UK consumer inflation data for June was also weaker than expected as the headline rate fell to 4.2% from 4.5% while the core rate retreated to below 3.0%. The decline will help ease immediate pressure for the Bank of England to raise interest rates which will maintain a lack of Sterling yield support.

The trade deficit was also wider than expected at GBP8.5bn for May from a revised 7.6bn previously. The data will increase doubts over the UK ability to secure growth through exports and will trigger a downgrading of growth prospects.

There could still be some defensive flows into the UK as a refuge from Euro-zone contagion, although UK yields will also be watched very closely for any evidence of stress and capital outflows. From lows below 1.58 against the dollar, Sterling rallied back towards 1.5950 while the Euro struggled to hold above 0.88.

Swiss franc

There were further strong franc gains during European trading on Tuesday as risk appetite deteriorated sharply. The Euro weakened to lows below 1.16 against the Swiss currency before rallying back to the 1.1650 area. The US currency was unable to gain any traction and tested support below 0.83.

Safe-haven considerations will remain extremely important in the short term and there will be further inflows into the Swiss currency as confidence in the Euro-zone remains extremely fragile. Statements from the National Bank will be watched very closely in the short term, especially as there will be pressure for the bank to intervene and at least stabilise market conditions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar was subjected to further choppy trading during Tuesday as risk conditions also fluctuated sharply. At the peak of Euro selling pressure, the Australian dollar weakened to lows near 1.0520 against the US dollar before rallying back to the 1.0640 area. There was some steadying in market conditions and there was also relief over the latest Chinese GDP data.

Domestically, a sharp decline in consumer confidence had some negative impact on confidence and volatility is likely to remain a key threat in the short term.