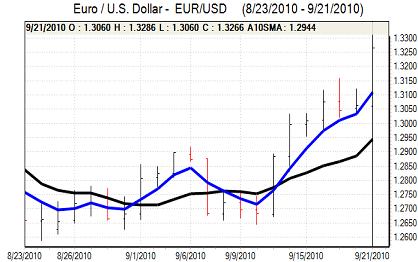

EUR/USD

The dollar nudged weaker in Asian trading on Tuesday in subdued conditions with the Euro hitting resistance near 1.31 in generally cautious market conditions.

During the European session, the Euro secured further buying support with a high close to 1.3150 against the dollar. There was a series of broadly successful debt auctions within the Euro-zone with solid demand for Spanish, Irish and Greek bonds in the latest offerings. Solid demand for securities boosted confidence that the weaker peripheral countries would be able to fund their deficits and this also cushioned the Euro.

There were still some underlying reservations of the underlying financial-market stresses which limited Euro buying support.

The US housing data was slightly stronger than expected with a gain in starts to an annualised rate of 0.60mn compared with 0.55mn previously and there was also a limited gain in permits for the month.

As expected, the Federal Reserve left Fed funds interest rates unchanged in the 0.00-0.25% range following the latest FOMC meeting with an 8-1 vote as Hoenig again dissented. The statement was generally cautious over the economic outlook and continued to suggest that interest rates would remain at very low levels for an extended period. There were also comments that it was prepared to provide additional stimulus if required.

Although there was no further quantitative easing by the Fed, the generally dovish statement undermined the dollar as US Treasury yields continued to fall. In this environment, the Euro tested resistance levels above 1.32 with a high near 1.3280 as stop-loss dollar selling escalated.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was a similar pattern in Asian trading on Tuesday with a lack of fresh incentives and narrow ranges. There was no sign of intervention by the Bank of Japan while there was a reluctance to take on additional positions ahead of the FOMC meeting. The dollar edged weaker towards 85.50 with some exporter selling a feature as resistance above 85.80 held firm.

The dollar drifted weaker during the European session with a lack of buying support due to nervousness ahead of the FOMC meeting and the US currency failed to gain support from stronger than expected US housing data.

There was no additional dollar yield support following the FOMC meeting and the US currency was also unable to secure any buying support. The dollar dipped to lows near 85 which will put renewed pressure on the Bank of Japan.

Sterling

Sterling remained generally on the defensive in early Europe on Tuesday with underlying negative confidence towards the currency.

The UK government borrowing data was weaker than expected with a GBP15.3bn deficit for August compared with an expected GBP13.5bn the previous year while the shortfall was also larger than expected.

The higher than expected deficit renewed fears over structural weaknesses within the UK economy. The immediate damage was curtailed by the Moody’s report yesterday which suggested that the AAA credit rating was safe for now, but sentiment is liable to deteriorate. There will also be fears over a renewed slowdown in the UK economy which will tend to limit near-term Sterling support.

Sterling tested support levels close to 1.55 before finding buying interest and then strengthened to a high above 1.56 as the dollar weakened sharply following the FOMC statement. Sterling remained firmly on the defensive against the Euro with 2-month lows beyond 0.8470.

Swiss franc

The Euro again found support close to 1.31 against the franc on Tuesday and strengthened to re-test resistance near 1.32. The dollar was unable to make any progress and tested support levels below parity following the Fed meeting.

There was a reduction in defensive Swiss franc support following the successful Euro-zone debt auctions which helped alleviate immediate fears over the Euro-zone debt sector.

The Swiss trade account for August was weaker than expected, but there was a solid performance for exports which will lessen pressure for a weaker franc to boost competitiveness.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

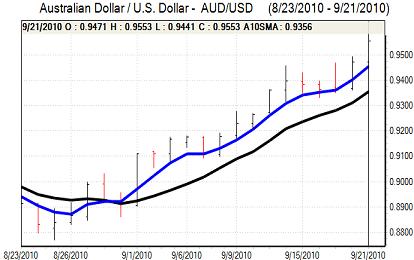

Australian dollar

The Australian dollar maintained a firm tone in Asian trading on Tuesday, holding above the 0.9460 support area. The currency maintained a firm tone in the European session as underlying risk appetite remained firm and there were further expectations of interest rate increases within the next few months.

International conditions remained very important and a generally weak US dollar allowed the Australian currency to rally to fresh 2-year highs above 0.95 following the US interest rate decision. The Australian dollar gained on yield grounds following a further decline in US 10-year yields while risk appetite held firm.