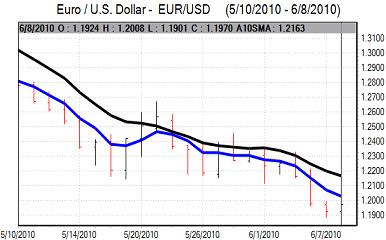

EUR/USD

The Euro found support above 1.19 against the dollar on Wednesday and secured robust gains during the European session with a peak around 1.2070. There was significant short covering during the day and the break above 1.20 triggered some stop-loss Euro buying.

There was a successful Portuguese bond auction which helped underpin confidence to some extent as yield spreads within the Euro area narrowed. It will still be much more difficult for the Euro to secure sustained relief given that underlying structural vulnerability will persist.

The ECB meeting will be watched very closely on Thursday, especially given the structural fears. There will be some speculation that the bank will introduce additional measures to boost liquidity and the Euro is likely to gain some support if the bank resists additional measures. Any ECB comments on the Euro’s level and speed of descent will also be watched very closely.

In testimony to Congress, Federal Reserve Chairman Bernanke stated that the economy was improving with gains in private demand. He did, however, also state that the recovery was modest and there was no suggestion in the rhetoric that the Fed was looking for a near-term policy tightening.

The Fed’s Beige book recorded gains in all 12 Fed districts which maintained some degree of optimism over the economy, but there was still an element of caution, especially surrounding investment. The Euro failed to sustain the gains later in New York and dipped back to below the 1.20 level as equity markets also struggled to make significant headway.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Domestically, core machinery orders rose 4.0% in the latest month which was below market expectations and structural fears surrounding the Japanese economy will remain an important feature.

Asian equity markets were unable to make much headway during Wednesday and a weaker Australian dollar also curbed carry-trade activity which offered protection to the yen with a reluctance to sell the yen aggressively. The dollar was unable to make much impression on the Japanese currency and was trapped below 91.50.

After a brief move above 91.50, the dollar was subjected to renewed selling pressure with the US currency weakening back towards the 91 area while the yen regained some ground against the Euro.

Sterling

Sterling found support close to 1.44 against the dollar on Wednesday and the ability to resist a further test of support below 1.4350 helped improve confidence on technical grounds. There was also some speculation that losses following Fitch’s budget deficit warning on Tuesday had been over-done.

The April June trade deficit was higher than expected at GBP7.3bn as exports were undermined by air-transport disruption. Given these potential distortions the market impact was limited, although the persistent trade gap could be a significant negative medium-term currency influence.

Attention will switch back to monetary policy on Thursday with the Bank of England interest rate decision. The bank is likely to leave policy n hold, but could decide to issue a tougher inflation warning in any statement which would provide some near-term Sterling support.

A round of short covering helped push the UK currency to a high just above 1.46 before a correction back to 1.4550. Volatility is likely to remain a key feature.

Swiss franc

There was continuing very high volatility during Wednesday as National Bank policies remained a key focus. After some initial support against the franc, the Euro was subjected to renewed selling pressure during the day.

The Euro weakened to a record low close to 1.3750 before securing a very limited recovery. Wider franc gains pushed the dollar to 3-week lows near 1.1410 before a recovery to 1.1480 as there was speculation that the bank could have intervened. There was confusion over the bank’s plans and this will maintain the threat of volatile trading.

Significant selling pressure on the franc remains unlikely while the Euro-zone structural fears persist.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

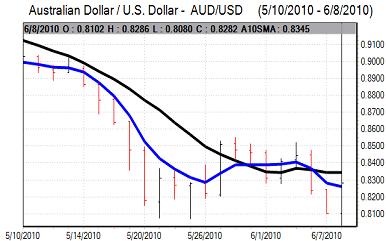

Australian dollar

The Australian dollar initially failed to sustain the gains on Wednesday as there was a reported decline in home loans. Reserve Bank Governor Stevens was also generally cautious over economic prospects which sapped currency support. Overall confidence in the domestic and international economy is likely to remain weaker which will limit currency support, but there was significant buying support at lower levels.

The Australian dollar pushed to a peak just above the 0.8350 level against the US currency, but failed to sustain the gains and weakened back to below the 0.83 level later in New York.