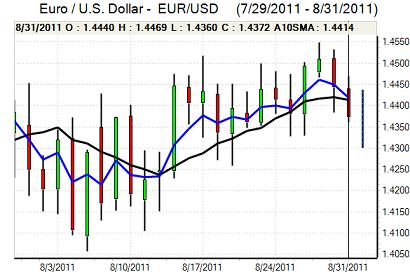

EUR/USD

The Euro was unable to break above resistance in the 1.4460 area on Wednesday and dipped sharply lower during the US session with a test of support below 1.4380. The currency also lost ground on the crosses with month-end positioning evident as a supportive dollar factor. There was buying interest at lower levels which helped curb further selling pressure.

The German government approved new powers for the EFSF, but there will be a tough battle to approve the legislation in the Bundestag given that several governing-party members are opposed to the changes. There were also increased fears that the complex rules surrounding the fund would prevent it responding effectively to a crisis.

There were further fears surrounding the Greek banking sector and unease surrounding the Euro-zone financial sector as a whole. More positively, there was a narrowing of most credit-default swaps during the day.

The latest ADP employment report registered private-sector job gains of 91,000 in August from a revised 114,000 previously. Given that government jobs have consistently declined over the past few months, there will be continuing expectations of poor payroll growth in the Friday employment report, maintaining expectations of further Fed action.

The Chicago PMI index fell to 56.5 for August from 58.8 previously, although this was higher than expected and provided some degree of optimism that a further sharp decline in the national PMI data could be avoided. This data will certainly be important on Thursday and any drop to substantially below the 50 level would increase fears over the economic outlook. The Euro edged lower in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained under pressure during European trading on Wednesday and tested support below 76.50 before regaining ground.

The Bank of Japan confirmed that its intervention during August was the highest amount since 2004 and there was further speculation that the government would take additional steps to weaken the Japanese currency.

Risk conditions remained import for the Japanese currency with a combination of rising equity markets and relief over the Chinese PMI data allowing Asian stocks to rise for the fourth successive day. Defensive demand for the yen eased and there was also an increase in overseas capital flows at the start of the new month which pushed the US currency to a high around 77.20 before another retreat lower.

Sterling

Sterling initially found support above 1.6250 against the dollar on Wednesday, but it was unable to break above the 1.6350 level and retreated again during New York trading with lows below 1.6230. There was further month-end related Euro demand against Sterling which undermined support as the Euro tested resistance levels near 0.89 before retreating.

Safe-haven demand for Sterling continued to decline, although the US and Euro-zone structural vulnerabilities were still important in curbing aggressive selling pressure.

Underlying confidence in the economic outlook remained weak as confidence within key sectors of the economy remains depressed. In this context, the PMI manufacturing data will be watched closely on Thursday. A weak outcome may not have an immediate policy impact, but would increase speculation that the Bank of England will eventually move to further quantitative easing.

Swiss franc

The dollar was unable to make a fresh move above 0.82 against the franc on Wednesday and retreated to lows just below 0.80 before finding support as the Euro also retreated sharply to lows near 1.15.

The government announced no new measures to weaken the franc and stated that the country would have to live with a strong currency. There were also suggestions that there was a disagreement with the National Bank over the effectiveness of measures and the combination of these factors triggered strong flows back into the Swiss currency.

Risk conditions will continue to be monitored very closely and the franc will tend to weaken again if there is relief surrounding the latest US PMI release.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support on dips towards the 1.0650 area against the US currency on Wednesday and challenged resistance levels above 1.07, but did find it difficult to make strong headway.

There was relief surrounding the latest data with a 0.5% increase in retail sales for July while there was also a firm reading for second-quarter capital spending. In contrast, there was another depressed reading for the PMI manufacturing series.

The Australian dollar also drew support from relief over the latest Chinese PMI data and a rise in Asian equity markets.