United Continental (UAL) is expected to grow EPS by 84.7% and revenue by 4.4% in 2014. The airline company only trades at a forward P/E ratio of 10.33 using Wall Street’s $3.97 FY EPS consensus estimate for 2014. On Wednesday January 8, United Continental reported a 4.1% increase in December consolidated traffic. They also said they expect Q4 unit revenue to rise between 2.8%-3.8% on a year over year basis.

Unusual Options Activity

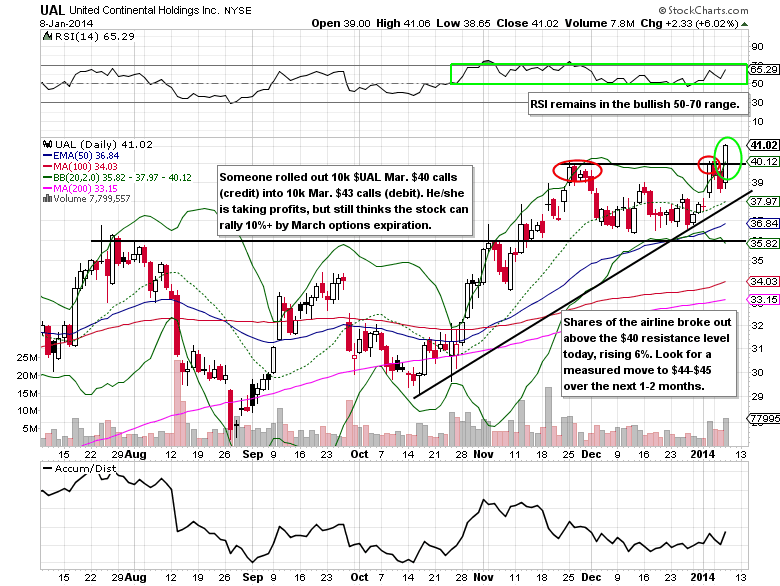

During Wednesday’s trading session someone rolled out 10,000 Mar. $40 calls (credit) into 10,000 Mar. $43 calls (debit). He/she is taking some profits off of the table, but thinks the stock can rise over 10% by March options expiration. The call to put ratio in United Continental options finished at 2.33, while implied volatility rose 2.98%.

The Technical Take

Shares of United Continental broke out above the $40 resistance level less than an hour before the large March call rollout. This sets up for a measured move to $44-$45 over the next 1-2 months. The Q4 earnings release that is due out on Thursday, January 23 could be the catalyst that sends the stock to the mid-$40’s.

United Continental Options Trade Idea

Buy the Feb $41/$44 call spread for a $1.20 debit or better

(Buy the Feb $41 call and sell the Feb $44 call, all in one trade)

Stop loss- None

Upside target- $2.50-$3.00

My Free Trade of the Day featuring Citrix Systems (CTXS)

= = =