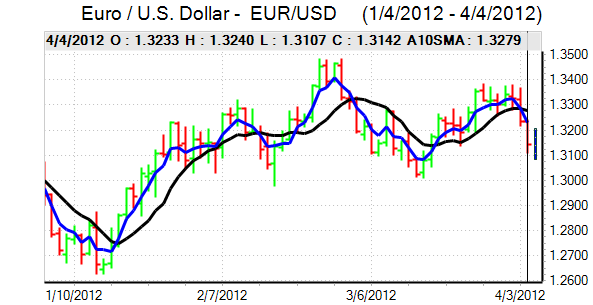

EUR/USD

The Euro was unable to make a move back above 1.32 against the dollar in Europe on Wednesday and was subjected to further selling pressure during the session.

There were further concern surrounding the Spanish economy with major doubts surrounding the effectiveness and sustainability of current economic policies. The latest bond auctions recorded weaker demand compared with previous sales and there was a sharp rise in short-term yields. The net effect was to trigger a further increase in market yields with 10-year yields rising towards 5.70%. There was also a slide in Spanish equities to the lowest level since November. Italian yields also rose during the day, maintaining fears surrounding renewed structural vulnerability.

The economic data was generally uninspiring with a decline in retail sales and smaller than expected increase in German factory orders, although there were upward revisions to previous data.

As expected, the ECB left interest rates on hold at 1.00% following the latest policy meeting. In the press conference, President Draghi stated that there were still downside risks to the growth outlook and that monetary policy would need to remain very accommodative. Although there would be near-term inflation risks associated with the rise in oil prices, he also stated that medium-term inflation remained firmly anchored. The comments increased speculation that the ECB will tolerate some increase in inflation within core Euro-zone economies in order to provide a boost to weaker economies which will tend to undermine the Euro.

The US ADP report was close to market expectations with a 209,000 increase in jobs for March following a revised 230,000 increase previously. The data will maintain optimism over a solid near-term expansion and continue to dampen any immediate expectations of further quantitative easing. Regional Fed President Williams, however, stated that further easing was not off the table. The ISM non-manufacturing index edged lower to 56.0 from 57.3 previously.

Sellers were unable to push the currency below the 1.31 level with a recovery back towards the 1.3150 region as volumes dropped ahead of the Friday market holidays and payroll data.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked in the 82.75 area against the yen on Wednesday and dipped sharply to lows in the 82.10 region during the European session with reports of aggressive selling by a UK bank. The US currency was also undermined by a decline in US yields, but there was some recovery following the latest US employment data.

Risk appetite failed to gain any significant boost from the Chinese services PMI data and a slight increase in Chinese equities with the dollar testing support in the 82 area as the yen maintained a firmer tone on the crosses. Speculation that the Bank of Japan would introduce fresh policy easing next week curbed aggressive yen buying.

Sterling

Sterling was unable to regain the 1.59 level against the US dollar on Wednesday and dipped to lows near 1.5825. The UK services PMI index was stronger than expected with a rise to 55.3 for March following a figure of 53.8 previously as business confidence continued to improve. All the PMI indices have been stronger than expected this week which will maintain a mood of greater confidence surrounding the economy. The Halifax house-price index recorded a 2.2% increase for March, although this was primarily due to buying support before tax reliefs ended.

The data will also reinforce expectations that the Bank of England will resist any further move to expand quantitative easing at the latest policy meeting with the announcement due on Thursday.

Sterling found support at lower levels against the dollar with a move back to the 1.59 area. It also secured a further advance against the Euro with a move to the 0.8265 area, the strongest level since early February.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

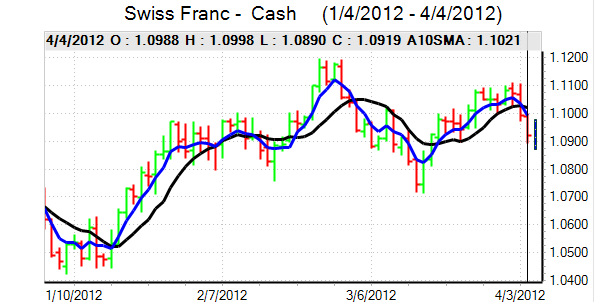

Swiss franc

The dollar found support in the 0.91 region against the franc on Wednesday and pushed to highs in the 0.9175 region before nudging slightly weaker later in the US session.

National Bank member Danthine reiterated that the franc was overvalued and that the minimum level was a valuable tool to prevent further deterioration in competitiveness. The latest cabinet meeting was watched closely, especially with some speculation that a new permanent president would be announced, but there was no immediate announcement. The latest consumer inflation data will also be important and a weaker than expected reading would tend to revive deflation fears.

Australian dollar

The Australian dollar was unable to regain the 1.03 level against the US currency on Wednesday and retreated to test support just below the 1.0250 level which was the weakest since early January. The currency was undermined by a general deterioration in risk appetite as equity markets retreated following the FOMC minutes. There was also further selling on expectations of an interest rate cut at the May policy meeting.

Selling pressure eased in Asia on Thursday as support near 1.0250 held and there was some relief over the Chinese data, although Asian equity markets as a whole were generally on the defensive which limited currency support.