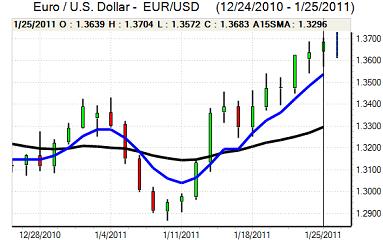

EUR/USD

The Euro found support on retreats to the 1.3580 area against the dollar in European trading on Tuesday and again rallied firmly during the US session.

The US consumer confidence data was stronger than expected with a gain to 60.6 for January from a revised 53.3 previously, but the dollar was unable to gain any traction. The Case-Shiller house-price index recorded an annual decline of 1.6% which reminded markets over the fragile housing sector.

Ahead of the State of the Union address, there were strong indications that president Obama would propose a five-year freeze for some discretionary spending and this had some impact in pushing US Treasury yields down which also tended to undermine the dollar. There were also expectations that the Federal Reserve would maintain a generally dovish tone at Wednesday’s FOMC meeting which also lessened any dollar support.

As far as the Euro is concerned, there was strong demand for the European Financial Stability Fund (EFSF) bonds which helped maintain a more optimistic tone towards the Euro. There were still important background concerns with a German official rejecting any increase in the EFSF and there were still reservations whether Spanish action to recapitalise the savings Banks would be sufficient.

The Euro rallied to the 1.37 area and was holding just below this level in Asian trading on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar rallied to test resistance above 82.60 following the US consumer confidence data, but it was unable to sustain the gains and weakened to test support close to 82 as US Treasury yields declined. The dollar will be in a position to rally strongly if there is a more hawkish than expected Federal Reserve statement, although this is not the most likely outcome.

Domestically, services-sector prices fell 1.3% in the year to December following a 1.1% previously and there will be further unease over the threat of deflation even though commodity prices have been generally strong. There is, therefore, likely to be further opposition to significant yen appreciation. In its latest monthly report, the Bank of Japan left its economic assessment unchanged and the dollar was trapped close to 82 late in the Asian session.

Sterling

Sterling drifted weaker ahead of the UK economic releases on Tuesday with a generally downbeat assessment by a senior government official reinforcing fears that the growth data was liable to be weaker than expected.

Even so, the actual fourth-quarter GDP estimate of -0.5% was substantially weaker than expected and was the first contraction for six quarters. There was a negative impact from adverse weather conditions and the data could be revised, but there was still a very negative impact on Sterling confidence with markets pricing out a rate increase until the third quarter.

Bank of England Governor King warned against reacting to high short-term inflation and this suggests a reluctance to raise interest rates even though he warned that the headline rate was likely to increase to 4-5%.

The Bank of England minutes will be watched closely on Wednesday, but any positive Sterling reaction to inflation warnings is liable to be tempered by fears that the economy will deteriorate further if borrowing costs are increased, especially given the impact of spending cuts to curb the budget deficit.

Sterling weakened very sharply to lows near 1.5750 against the dollar before recovering some ground as the US currency faltered while the Euro advanced to a 10-week high above 0.8650.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

Despite a generally robust performance generally, the Euro was unable to make any headway against the Swiss franc on Tuesday and retreated to test support below 1.29. The dollar was also on the defensive against the Swiss currency and weakened to a low near 0.94.

The franc was again resilient despite an improvement in confidence surrounding the Euro area and this continues to suggest that pressure for a reduction in long franc positions is easing. The currency will tend to gain renewed support if there is any renewed widening in Euro-zone credit-default swaps.

Australian dollar

The Australian dollar found support on dips to below 0.99 against the US currency on Tuesday and rallied to a peak just below parity during Asian trading on Wednesday. Australian markets were closed for a holiday which dampened activity to some extent.

Markets are still looking to take a positive attitude towards the global economy, but there are important risks surrounding the potential for further Asian interest rate increases which will curb confidence. Metals prices have also remained generally weaker which will sap support for the Australian currency.