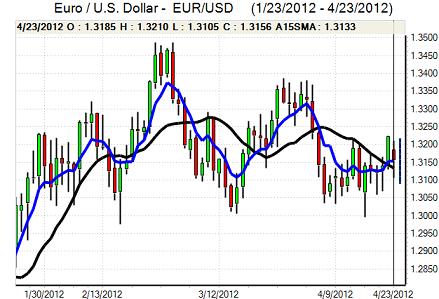

EUR/USD

The Euro was unable to stage a recovery in early Europe on Monday and was subjected to renewed selling pressure as economic and political uncertainty continued to escalate.

The Euro-zone PMI data was weaker than expected with sharply weaker readings for the French PMI services and German manufacturing data with the German industrial reading at the lowest level since 2009. Although the services data was stronger than expected, the net outcome was a decline for both the manufacturing and services Euro-zone PMI readings with the manufacturing index at the lowest level since July 2009.

The data tended to contradict more optimistic German business surveys, unsettling markets, and there was further peripheral economic unease. As well as the PMI data, the Bank of Spain confirmed that there was a further GDP contraction for the first quarter, maintaining fears over the economic outlook and the banking sector. There were no ECB peripheral bond purchases during the latest week but there were some rumours of price checking during the day.

Politically, markets were unsettled by the French election result as, although support for the main two candidates was close to expectations, the strong polling outcome for the National Front reinforced market fears that support for current economic policies was continuing to weaken. The Dutch government also tendered its resignation after failing to agree budget cuts as the Freedom party withdrew its support, maintaining fears over regional instability.

There were no economic data releases during the day and from an economic perspective, markets were focussed on the Wednesday Federal Reserve meeting.

The US currency gained support on defensive grounds as risk appetite deteriorated and there was a net flow of funds out of commodity currencies. The Euro weakened to lows just above the 1.31 level before finding support and rising back to the 1.3150 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar dipped to lows near 81 against the yen on Monday before finding support and edging higher.

Net market expectations were that the Federal Reserve would not announce any further quantitative easing at the policy meeting this week while the Bank of Japan would consider additional policy measures on Friday. This provided some dollar support, but the currency was still hampered by the lack of interest rate support as US yields dipped to six-week lows.

The dollar and yen both gained defensive support from a deterioration in risk appetite as equity markets weakened sharply. There was some stabilisation in conditions later in the New York session and the Euro rallied from lows near 106.25. The dollar edged lower during the Asian session on Tuesday with a fresh dip to below the 81 level.

Sterling

Sterling hit resistance close to 1.6120 against the dollar on Monday and dipped to lows near 1.6080 as there were wider US gains on a deterioration in risk conditions.

According to the latest Bank of England survey, lending conditions for small businesses remained extremely weak which will maintain concerns over the underlying growth conditions. Sterling was still able to maintain a firm tone throughout the day, although there were major uncertainties whether the support was related to enthusiasm for the UK currency or whether it primarily reflected a lack of confidence in the Euro-zone outlook. There was a strong suspicion that defensive demand was the principal factor driving demand.

In this context, Sterling found support close to 1.6080 before rallying back to the 1.6120 area as risk conditions stabilised and the trade-weighted index pushed to fresh 20-month highs.

Swiss franc

The dollar found support above the 0.91 level against the franc on Monday and rallied to a peak near 0.9170 early in the US session, but it was unable to sustain the gains. The Euro was able to secure marginal gains against the Swiss currency, although movement remained extremely limited.

There were further political and economic doubts surrounding the Euro-zone which continued to trigger some defensive flows into the franc. The National Bank commitment to maintaining the franc cap is likely to remain under short-term pressure. The latest trade data recorded a small dip in exports for the first quarter, maintaining competitiveness fears.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar remained under pressure during the European session on Monday with a test of support levels near 1.03 and the currency dipped below this level as there was a net deterioration in risk appetite. The currency dipped to lows near 1.0270 before rallying back to the 1.03 area as equity markets stabilised.

The latest inflation data was sharply weaker than expected with a 0.1% first-quarter increase compared with a consensus forecast of 0.7% while the core rate was half the expected figure at 0.3%. The Reserve Bank has suggested that the inflation data was key for the prospects of further monetary easing and the data reinforced expectations of a cut next week. The Australian dollar weakened sharply to lows just below 1.0250 against the US currency.