EUR/USD

The Euro hit resistance just above 1.3850 against the dollar on Wednesday and drifted weaker, although ranges were relatively narrow with the US currency unable to make much impression. There was a slightly more cautious attitude towards risk which curbed Euro buying support with markets still fretting over the possibility that Middle East tensions could intensify.

The headline US ADP employment report recorded an increase in private-sector jobs of 187,000 for January which was again above market expectations. The impact was tempered to some extent by a downward revision to December’s data and there was an element of caution given that the official data did not match the ADP optimism last month. Underlying optimism in an improving US economy is also being tempered by expectations that the Federal Reserve will be very slow to tighten.

Standard & Poor’s downgraded Ireland’s sovereign rating to A- from A which hampered the Euro and there were also expectations that an opposition victory in the February 25th General Election would result in a re-negotiation of Irish bailout terms which would force bondholders to accept increased losses. There will be fears over more populist policies within the Euro area over the next few months which would also increase wariness over Euro-zone bonds.

Sources within the German government also indicated that they would oppose any proposals to allow the EFSF to buy existing Euro-zone debt. For now, markets may be prepared to give the governments more time to strengthen the Euro-zone crisis mechanisms, but any signs of severe stresses at Friday’s EU summit would still be an important negative Euro factor.

The Euro drifted weaker to just below 1.3780 before consolidating close to the 1.38 area

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 81.30 against the yen on Wednesday and pushed to a high near 81.80 in late US trading, but it was unable to make a challenge on the 82 area and weakened back to 81.60 during the Asian session on Thursday. Risk appetite was slightly more fragile which provided some background yen support.

The US economic releases were generally favourable and the dollar gained some support on yield grounds. There will be caution ahead of Friday’s payroll data, but a strong release would reinforce the case for higher US yields and underpin the currency against the yen.

Comments from Finance Ministry officials will continue to be watched very closely given the potential for intervention as the dollar remains close to record lows against the yen.

Sterling

Sterling has maintained a strong tone over the past 24 hours and advanced to a high just above 1.6220 before correcting weaker. The UK currency was also able to strengthen to 0.8520 against the Euro.

The construction PMI data was stronger than expected with a recovery to 53.7 for January from 49.1 the previous month. Part of the recovery is likely to have been weather related and the services-sector data will be watched very closely on Thursday for further evidence.

MPC member Sentance maintained his preference for a small rise in interest rates to prevent the risk of a larger increase later. Fellow member Bean was much more cautious over the need for higher borrowing costs, but did concede that higher commodity prices could force a change. Markets overall were more aggressive in pricing in rate increases which helped underpin Sterling.

There will still be important reservations over the economy and sentiment is still liable to fluctuate sharply. The UK currency dipped to lows near 1.6140 before recovering back towards 1.62.

Swiss franc

The Euro maintained a firm tone against the franc on Thursday and tested resistance above 1.30, but it was unable to sustain a move above this level. The dollar found support near 0.9330 against the Swiss currency and advanced to a high around 0.9430 before correcting back to the 0.94 area.

There will be a reduction in defensive franc demand if there is a sustained improvement in sentiment surrounding the Euro-zone and there has been pressure for a closing of short Euro positions. The National Bank would certainly welcome a further Swiss retreat, but volatility is liable to remain an important near-term market feature as the Euro-zone stresses remain under debate.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

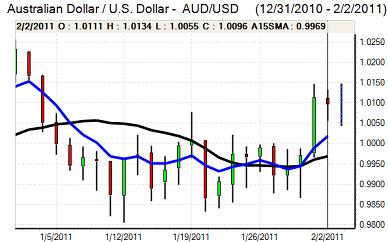

The Australian dollar hit resistance close to 1.0140 against the US dollar on Wednesday and it retreated to a low around 1.0065 before regaining ground. The currency gained underlying support from the high level of commodity prices and general optimism surrounding the global economy.

The domestic data was mixed as gains in building approvals were offset by another reading below 50 for the PMI services-sector index. The Australian dollar will also be hampered if there is any sustained deterioration in risk appetite.