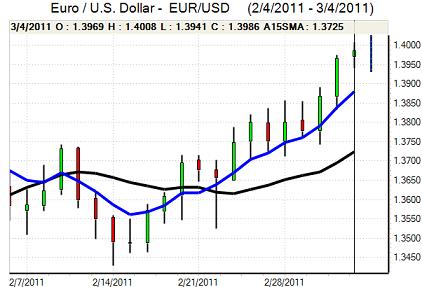

EUR/USD

The Euro traded in narrow ranges around 1.3950 against the dollar ahead of the US payroll data on Friday, but maintained a generally firm tone as yield support remained intact.

The US data was broadly in line with official expectations as headline employment rose by 192,000 for the month following an upward revision to the previous month’s data. The unemployment rate also fell again to 8.9% from 9.0%. There was a further decline in government employment for the month, illustrating the negative influence of state spending restrictions and the government sector is likely to remain a net drag on the economy. Markets had also been anticipating a stronger report and the dollar failed to gain any significant benefit from the data.

Despite the firm data, there were further expectations that the Fed would be very slow to tighten. German bund yields also remain higher following the ECB’s warning that interest rates would be increased in April.

EU developments will still need to be watched very closely as underlying stresses persist. The new Irish government will look to re-negotiate the EU/IMF support package and there will certainly be further stresses within German as the government looks to avoid further state-level electoral defeats. Ratings agency Fitch also issued a negative watch on Spain’s rating outlook.

The Euro pushed to challenge 1.40 during US trading and did push above this level briefly before edging lower. The speculative positioning data recorded the largest net long Euro position since October which may curb further buying support as it consolidated near 1.3975 on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The strengthened ahead of the US employment data on Friday, but the advance was very short-lived and it failed to hold the gains with selling pressure close to 83.0. The currency then weakened sharply to lows just below 82.20 with the Japanese currency maintaining a firm tone on the crosses.

Risk appetite was generally weaker as Middle East tensions continued to simmer and oil prices remained at extremely high level which will tend to underpin the yen.

Internally, there was further evidence of corporate yen buying ahead of the fiscal year-end and evidence of capital repatriation by Life Insurance companies. This will remain an important feature over the next two weeks. There was still an underlying lack of confidence in the Japanese fundamentals with expectations of longer-term depreciation.

Sterling

Sterling retreated to lows near 1.6240 against the dollar in European trading on Friday and was then subjected to very choppy trading, generally within a 1.6240 – 1.63 range.

Domestically, the Halifax house-piece index reported a 0.9% decline in house prices for February, the sharpest decline for 9 months, and this reinforced a lack of confidence surrounding the housing sector.

Interest-rate expectations will remain extremely important ahead of this Thursday’s Bank of England MPC decision. Bank Governor King stated over the weekend that he was still a hawk on monetary policy, but there was also a recognition over the impact of a tight fiscal policy on monetary policy. The bank remains concerned over the economy’s trajectory over the next few months and major policy doubts will continue.

Given that markets are not pricing in a rate increase this week, Sterling should be able to avoid heavy selling pressure. A deterioration in risk appetite would, however, have a negative impact and the UK currency held near 1.6250 in Asia on Monday with the Euro just above 0.86.

Swiss franc

The dollar failed to hold above 0.93 against the Swiss franc during Friday and, despite volatile trading, there was net downward pressure following the US employment data with the currency dipping to a low near 0.9225 before stabilising. The Euro was also unable to hold above 1.30 against the Swiss currency following sharp gains recorded the previous day.

Risk conditions will inevitably remain extremely important and the franc will continue to gain defensive support when confidence deteriorates, especially if there is a further increase in oil prices. Comments from National Bank members will continue to be watched very closely in the short term with member Jordan stating last week that there was no immediate case for intervention.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

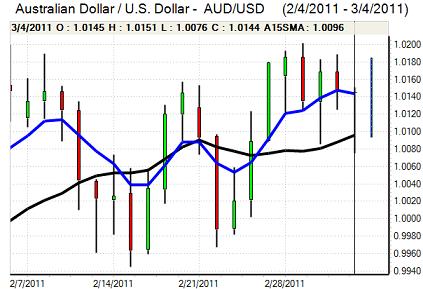

Australian dollar

The Australian dollar dipped to below 1.01 against the US dollar following the US employment report, but quickly regained support and pushed to a high above 1.01050 before edging lower again in Asian trading on Monday.

The currency will continue to be influenced strongly by trends in risk appetite and underlying demand for the currency will be weaker when confidence in the global economy deteriorates.

Domestically, the PMI construction index remained below the 50 level which did not have a substantial impact, but underlying confidence in the economy is liable to be fragile.