EUR/USD

The Euro initially hit resistance close to 1.40 against the dollar on Thursday, but accelerated sharply during the US session as there was a wider slump in the US currency as it was subjected to the largest decline for two years. There was a further improvement in risk appetite following the EU Summit as equity markets rallied and there were particularly sharp gains for the banking sector.

There was important relief that EU leaders had managed to stave-off the immediate threat of a Euro collapse which encouraged a closing of short positions and also curbed defensive demand for the US currency as emerging-market currencies also secured strong gains.

There was still concern over the lack of detail in the plans and fundamental doubts will continue. The ECB remains concerned over the mechanisms for expanding the EFSF fire-power, fearing the implications of increased leverage and there will also be very important political doubts. There were doubts within Germany and there were also further protests within Greece as the implications of continued austerity with fears that recession conditions would continue.

The US data was slightly better than expected with third-quarter GDP growth of 2.5% from 1.3% previously while jobless claims fell slightly in the latest week to 402,000 from 404,000. The data will help underpin confidence to some extent, but there will still be a high degree of unease over the US fundamentals and the dollar will remained dependent on defensive support to make headway, especially given the shift in yields.

This risk was illustrated by a sharp drop in overseas US Treasury bonds in the latest reporting period.

The Euro rallied sharply to a 7-week peak near 1.4250 before edging lower in Asian trading on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any impression on the yen during Thursday despite a brief gain following the US GDP data and it was unable to make any impression above the 76 level.

The latest Japanese inflation data was in line with expectations while there was a decline in unemployment to 4.1% from 4.3% previously, in contrast to expectations of an increase. In contrast, there was a much weaker than expected reading for industrial production with a 4.0% decline in output after a 0.6% gain previously while there was a further decline in household spending.

There will certainly be Bank of Japan unease over the industrial data and increased pressure for the Finance Ministry to resist further yen gains against the dollar. These concerns will persist even though the Japanese currency has weakened against the Euro.

Sterling

Sterling found support on dips to below the 1.60 level against the US dollar on Thursday and there were fresh gains to the 1.61 area in US trading as the UK currency gained support from a wider retreat in the US currency with a peak near 1.6140 while the Euro moved to above the 0.88 level.

The latest UK consumer confidence data recorded a decline to -32 for the latest month from -30 previously which was a 32-month low as sentiment remained weak. Although there was a slightly stronger reading for the latest CBI retail sales survey, it remained in negative territory at -11 from -15 previously and there were further doubts surrounding the spending outlook.

There was relief surrounding the UK banking sector following the EU Summit as there was a sharp gain in equity markets. There may be reduced fears surrounding the threat of capital flows out of the UK financial sector, at least in the short term, although there will also be unease surrounding the medium-term outlook as European banks still have to raise substantial amounts of capital.

Swiss franc

The dollar remained under heavy selling pressure against the franc on Thursday and dipped to lows below 0.86 before finding some support. The Euro was unable to make any impression on the Swiss currency and there was a test of support below the 1.22 level despite an improvement in risk appetite as the breakdown in traditional relationships continued.

The latest Swiss KOF business confidence index will be released on Friday and a sharper than expected downturn to a two-year low would increase unease surrounding the economy. There would also be increased pressure for the central bank to take further action to limit franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

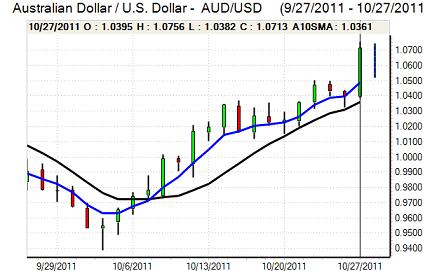

The Australian dollar resisted selling pressure during Thursday and there were further substantial gains during the New York session as the US dollar was subjected to wider selling pressure. There was a peak close to the 1.0750 which was the highest level since the first week of August as high volatility continued.

Risk conditions will continue to dominate in the short term and relief surrounding the EU Summit will continue to underpin the Australian dollar in the very short term. There will be some caution surrounding the Reserve Bank monetary meeting next week with speculation that there will be a cut in interest rates.