EUR/USD

The Euro consolidated comfortably above 1.3220 against the dollar ahead of the US payroll data on Friday. The US data was substantially weaker than expected with the increase in non-farm employment held to 39,000 for November from a revised 172,000 the previous month and compared with expectations of an increase closer to 150,000. In a further setback, the unemployment rate also rose to 9.8% from 9.6%, the highest figure since May.

The data will dampen sentiment towards the US economy even though the data is inevitably volatile on a monthly view. In this context, there will be a continuing focus on Federal Reserve policies and remarks from Chairman Bernanke were important over the weekend. The Fed chief stated that further quantitative easing and an extension of the US$600bn bond-buying programme could be considered if necessary. Bernanke also stated that a double-dip recession was unlikely which curbed dollar selling.

The Euro-zone structural vulnerabilities receded from the attention briefly on Friday, but they will still be an extremely important focus over the next few weeks. Markets will monitor comments from EU officials closely at the beginning of the week. There will be pressure for pre-emptive measures to lessen the threat of contagion and the risk of further severe internal stresses.

The Euro strengthened sharply to a high close to 1.3420 following the US data on Friday, but it was unable to sustain the gains on Monday and weakened back to the 1.3340 area with choppy trading liable to remain a key feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked close to 83.80 ahead of the US employment data on Friday as caution prevailed and the weaker than expected data had a powerful effect with a sharp decline to the 82.60 area. Reduced yield support will make it more difficult for the currency to make headway.

Trends in risk appetite will remain important and the yen will gain some degree of support from any renewed fears over the global economy, but equity markets have proved broadly resilient which will tend to limit yen support.

The regional political situation will remain important with further stresses surrounding the Korean situation. Tensions are liable to continue in the near term, especially with further military exercises due within the next few days and this will tend to limit yen support.

Sterling

Sterling hit resistance close to 1.5650 against the dollar ahead of the US payroll data on Friday, but losses were limited and dollar moves then dominated over the remainder of the day. A weaker US currency allowed Sterling to advance to a peak near 1.58 against the dollar before a retreat to the 1.5740 area.

Domestically, the British Chambers of Commerce lowered its GDP forecasts for the next year, but markets will tend to be dominated by evidence rather than forecasts.

The PMI data for the services data recorded a decline to 53.0 for November from 53.2 the previous month which will tend to dampen confidence to some extent as it illustrates that the services sector will find it difficult to secure momentum and this will tend to limit Sterling buying support, especially with expectations of a sharp slowdown during the first quarter of 2011.

Swiss franc

The dollar drifted close to the 0.99 support level ahead of the US payroll data on Friday and then weakened sharply following the data with a decline to lows below 0.9780 following the data and the US currency was unable to secure any significant recovery. Cross-rate moves remained potentially very important and the franc was able to advance against the Euro at the time same which magnified the dollar losses.

The franc will gain some support if there are increased doubts over the global growth outlook. The Euro’s inability to make progress against the franc even when immediate Euro fears ease illustrate that the franc could gain strong defensive inflows.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

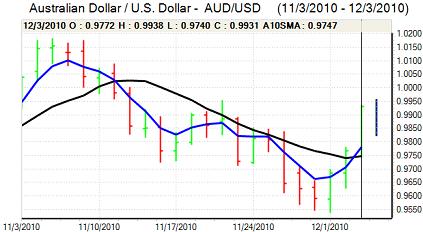

Australian dollar

The Australian dollar held above 0.9750 against the US currency on Friday and advanced strongly to a high above 0.99 following the US data. US currency weakness tended to dominate and markets will remain interested in alternative currencies given underlying fears over the dollar and Euro. There will still be unease over the global growth outlook which will tend to limit support for the Australian currency.

Domestically, the latest Reserve Bank of Australia meeting will be watched closely on Tuesday and the most likely outcome is that rates will be left unchanged. Any decision to change rates would have a big impact on the Australian currency.