EUR/USD

There was a brief Euro move to the 1.3970 area on Wednesday, but the currency then fell sharply during the US session. There were rumours of disagreement among key leaders and a possible breakdown in negotiations ahead of the EU Summit which pushed the Euro to lows close to 1.38 before a recovery.

Leaks and media briefings from within the Summit suggested that progress was being made and this pushed the Euro higher again. In the event, leaders secured slightly more than had been expected by markets. There was agreement to increase core capital ratios within European banks to 9% by 2012 while the EFSF fire-power would also be increased to around EUR1.0trn through leverage, although precise details had yet to be worked out.

There was some surprise and relief on Greece as leaders agreed on a notional ‘voluntary’ 50% restructuring of private-sector Greek debt while there would be a revised EUR130bnsecond loan package for Greece. The IIF agreed to the restructuring plan after effectively being told that the alternative would be a full-scale hard default.

There was important relief that negotiations had not broken down at the Summit and this helped trigger gains to just below 1.40 against the dollar as markers looked to challenge option barriers and trigger stop-loss Euro buying. There was also relief that the Italian government had managed to secure agreement on pension reform. There were still concerns over the implementation of plans, especially given the weaker economic outlook and risk of back-sliding. There will also need to be detailed negotiation with Greek bond-holders.

The headline US durable goods report was weaker than expected with a 0.8% monthly decline, although there was a core 1.7% increase which offered some support to sentiment. There was further speculation that the Federal Reserve would eventually move to sanction additional quantitative easing which curbed dollar support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any headway against the yen during Wednesday as it re-tested record lows below 75.80 before finding some degree of relief. There was a weaker yen tone on the crosses following the EU Summit as risk appetite improved and this helped push the dollar to the 76.30 area where fresh selling pressure emerged.

The Bank of Japan left interest rates on hold at a maximum of 0.10%. The central bank also expanded its asset-purchase programme to JPY55trn from JPY50trn previously in an 8-1 vote. The Finance Ministry voiced frustration over the yen’s valuation and blamed speculative pressures, but there was no immediate evidence of an aggressive plan to intervene.

An easing of immediate fear surrounding the Euro area should help ease yen support on defensive grounds, especially if there is an improvement in confidence surrounding the banking sector, but sentiment is still liable to be very fragile.

Sterling

Sterling continued to fluctuate around the 1.60 area against the dollar ahead of Wednesday’s EU Summit before briefly dipping sharply to the 1.59 area as it tracked wider US moves. A fresh retreat for the US currency allowed Sterling to test resistance above 1.60 in the Asian session on Thursday.

The latest UK CBI industrial survey was weaker than expected with a decline to -18 for October from -9 previously which will maintain unease over the economic outlook.

The Bank of England is continuing to take a gloomy tone on prospects and consumer spending levels remain under heavy pressure. The banking sector will also be an important focus an easing of fear surrounding Europe would also lessen the risk of capital flows out of Sterling, although markets will inevitably remain extremely nervous over the outlook

Swiss franc

A dollar rally against the franc was blocked in the 0.8850 zone in US trading on Wednesday and the US currency retreated to lows near 0.8760 as there was a general decline in the US currency. The Euro did find support in the 1.2220 area against the franc, but it was blocked below the 1.23 level despite a better than expected Summit outcome.

National Bank actions will continue to be watched closely in the short term and, although the Euro level is vital for the Swiss economy, any widespread dollar selling would increase pressure for the Swiss central bank to push the Swiss currency weaker.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

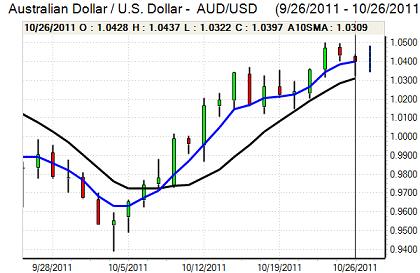

Australian dollar

The Australian dollar initially maintained a weaker tone on Wednesday as the weaker than expected core inflation figure increased speculation that the National Bank would be able to move towards a cut in interest rates. From lows near 1.0320, the currency rallied sharply following the EU Summit and tested resistance above the 1.05 level.

There was a general improvement in risk appetite which helped underpin the currency, especially with the US dollar generally on the defensive. Any flows of Chinese capital into Europe would also help underpin the Australian currency. High volatility is likely to remain the key short-term market feature.