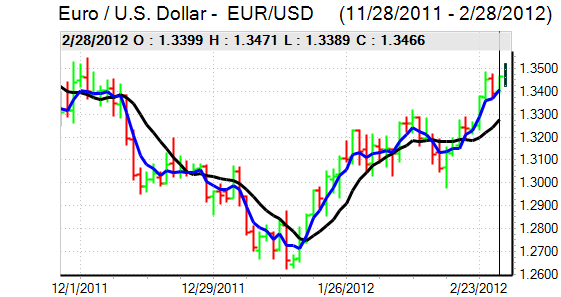

EUR/USD

The Euro again found support below 1.34 against the dollar in choppy trading conditions during Tuesday. There was a general mood of optimism that the ECB long-term repo operation (LTRO) would be very important in underpinning risk appetite and also provided support for the Euro on hopes that there would be additional support for peripheral bonds and the Euro-zone banking sector with expectations that allocated funds would be in the EUR500bn area. There will be the risk of high volatility following the repo announcement.

The positive expectations were offset by the announcement from Ireland that the government will hold a referendum on the EU proposed fiscal compact. The holding of a referendum will inject fresh uncertainty over the medium-term outlook even though there was little market confidence in the concept of a fiscal compact in the first place.

The US economic data was very mixed during the day which also confused market activity. The durable goods orders was much weaker than expected with a 4.0% decline in durable goods orders while there was a 3.2% underlying decline in orders for the month. The Case-Shiller house-price index was also weaker than expected with a 4.0% decline over the year.

In contrast, there was a stronger than expected reading for consumer confidence with a rise to 70.8 for February from a revised 61.5 reading previously while there was a robust reading for the Richmond Fed index. There will be optimism surrounding consumer spending, but there will also be fears that weak investment will undermine the longer-term outlook. Markets will watch Fed Chairman Bernanke’s comments on the economy very closely during Wednesday’s congressional testimony.

The Euro dipped to lows below 1.34 against the dollar before recovering to the 1.3470 area as wider risk appetite remained generally robust and curbed demand for the US currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was confined to narrower ranges during Tuesday with support on dips to below the 80.20 area while there was resistance above 80.80. The US data was unable to provide sustained support for the US currency, although there was relief surrounding the consumer confidence data.

There were further underlying concerns surrounding Japan’s competitive position following further stresses within the high-tech sector and this will maintain pressure for a more aggressive Bank of Japan stance. There was some relief from the latest industrial data as production rose 2.0% for January following a 3.8% gain previously while the PMI index was little changed.

The Japanese currency edged weaker as risk appetite improved with the dollar resisting a test of support in the 80 area.

Sterling

Sterling was initially unable to challenge serious resistance levels in Europe on Tuesday, but held a generally firm tone with the US currency also unable to gain any sustained traction.

The latest CBI retail sales survey was significantly stronger than expected with a reading of -2 for February from -22 previously and there was also a slightly more optimistic tone surrounding March, although there was still a high degree of uncertainty surrounding the situation. Consumer confidence was unchanged at -29 according to the latest GfK survey.

Sterling also gained support from a generally robust tone surrounding risk appetite and following a sharp dip to below 1.58 on the Irish referendum plans, the UK currency rallied strongly to a peak above 1.59 which was a fresh 3-month high for the currency with the Euro unable to make a challenge on the 0.85 region.

Swiss franc

The dollar was again unable to hold above the 0.90 level on Tuesday while there was support below the 0.8950 level. The Euro was trapped close to the 1.2050 level during the day, unable to move significantly away from support levels even though risk conditions were firm.

National Bank interim Chairman Jordan in essence repeated the standard bank rhetoric on the franc with comments that the 1.20 minimum level would be defended with the utmost determination. Jordan tended to concentrate on the European economic outlook and he was more alarmist than expected in his prognosis of the debt situation which will cause some unease over the underlying situation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

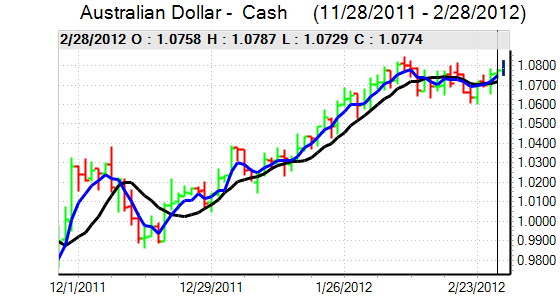

Australian dollar

The Australian dollar maintain a firm tone during Tuesday, but it was unable to break above the 1.0780 region before drifting weaker later in the US session. There was some disappointment over the US industrial data.

The domestic data was mixed with retail sales broadly in line with expectations recording a 0.3% increase for January. There was a further sharp decline in home sales and construction orders also fell in the fourth quarter.

Risk conditions were generally favourable in Asia on Wednesday as equity markets looked to rally again and this helped the Australian dollar test resistance above the 1.08 level against the US dollar.