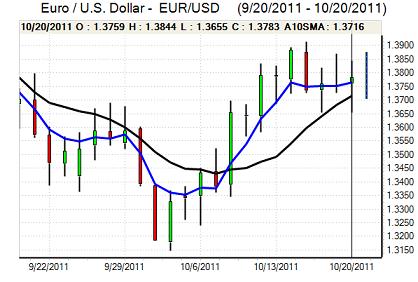

EUR/USD

Euro volatility spiked higher again during Thursday as markets continued to react to Euro-zone developments and early optimism which pushed the Euro to highs above 1.3820 was not sustained.

Negotiations over the EFSF continued ahead of the planned Sunday EU Summit with a particular focus on disagreement between France and Germany. The French government still wants the EFSF to be made into a bank and for the ECB to play an increased role in providing guarantees and using its balance sheet to boost the fund. There is strong German opposition to this, not least because Chancellor Merkel would face strong opposition from within parliament.

There were rumours that the Sunday Summit would be postponed, but the French insisted that it should go ahead and, instead, there will be a second meeting probably on Wednesday 26th where final agreement will be secured. There was also still no agreement on increasing the ‘voluntary’ haircuts on private-sector Greek debt holdings with France resisting bigger adjustments due to the risks this would pose to the banking sector. Italian bond yields continued to rise and approached the 6.0% level.

The troika report on Greece was finally published and the IMF concluded that the situation was more difficult than expected as a deeper recession put further downward pressure on tax revenues and undermined agreed budget targets. The troika still recommended that the next loan tranche should go ahead as planned as Greece approved austerity measures.

The US economic data was generally stronger than expected with jobless claims falling 6,000 to 403,000 in the latest week while there was a sharp recovery in the Philadelphia Fed index to 8.7 for October from -17.5 previously. Although existing home sales weakened slightly, there were increased hopes that the economy could avoid recession.

The Euro dipped sharply to lows just below 1.3660 against the dollar as EU disagreements intensified before rallying back to the 1.3775 area later in New York trading on hopes that a solution would be found.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar briefly pushed above the 77 level against the yen on Thursday as US yields increased, but it was unable to sustain the move and weakened aback to the 76.80 area. The US economic data provided some net support for the dollar as recession fears eased slightly and Wall Street edged higher.

There was some evidence of yen selling against the Swiss franc as there was an unwinding of long yen positions taken out against the franc.

There was further speculation over potential repatriation flows from Europe which continued to limit the potential for yen selling. Finance officials confirmed that there would be a JPY2trn package of measures to cope with the yen’s surge as the dollar held below the 77 level.

Sterling

The UK currency remained generally resilient on Thursday even though there was volatile trading during the day. The latest retail sales data was stronger than expected with a 0.6% headline increase for September following a revised 0.4% decline the previous month. There was a rebound in some categories, but discretionary spending was still weak and there will be further fears surrounding the outlook, especially as the Nationwide consumer confidence index fell to near record lows of 45 for October.

The UK and Euro-zone banking sectors will remain an extremely important focus in the short term. There will be speculation that Euro-zone banks will pull funds out of the UK in order to bolster capital ratios and this would risk further serious damage to the UK economy. For now, Sterling is gaining some support from its position outside the Euro-zone and from lows below 1.57 there was a recovery back to the 1.58 resistance area.

Swiss franc

The dollar was blocked in the 0.9040 area against the franc on Thursday and weakened to lows in the 0.8940 area. In contrast to recent sessions, the moves were driven to a large extent by the Euro/Swiss cross. The Euro was subjected to significant selling pressure as it dipped to lows below 1.2250. There were fresh fears surrounding the EU banking sector which provided some franc support, especially with disappointment that there had been no move to raise the minimum franc level earlier in the week.

The Swiss ZEW business confidence index improved to -54.4 for October from -75.7 the previous month which will ease fears over a very sharp downturn in the economy, although it will also maintain pressure for further franc gains to be resisted.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar was unable to escape the volatility seen in other currency pairs on Thursday. It found support in the 1.0150 area against the US currency and rallied to the 1.03 area before being subjected to fresh selling pressure.

As well as the volatility surrounding the Euro-zone economy, there was further unease over commodity prices as copper prices continued to decline and there were continuing uncertainties surrounding the Chinese outlook. There was still solid buying support for the currency on dips and volatility is liable to remain a key feature.